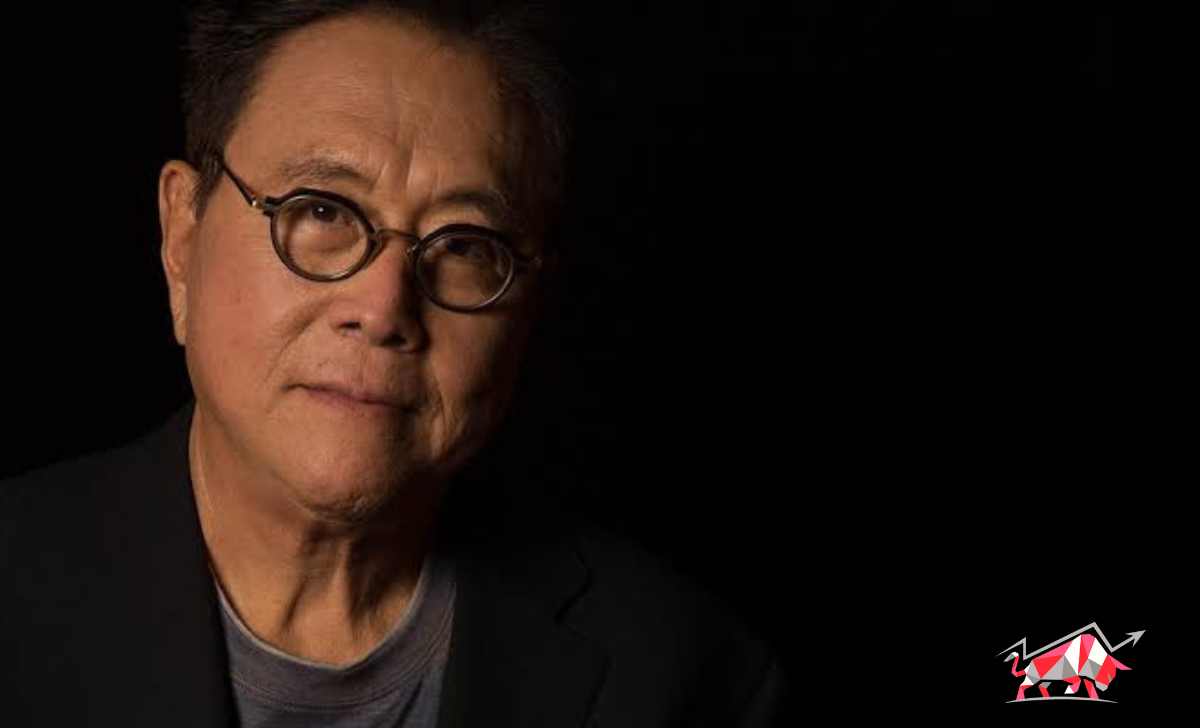

Popular author, Robert Kiyosaki explained why people should buy BTC, gold, and silver now even though he predicted that their values may drop much more.

The best-selling book predicts that the US Federal Reserve will keep raising interest rates, which will eventually drive the price of BTC, gold, and silver further down. However, this creates a favorable purchasing opportunity that could in the future bring investors joy.

Robert Kiyosaki Advises to Buy Bitcoin Now

Robert Kiyosaki was formerly one of the bitcoin detractors, but the COVID-19-caused crisis caused him to alter his view, and he has since compared bitcoin to commodities like gold and silver.

In his most recent tweet on the subject, he discussed the Fed’s recent monetary strategy, in which the central bank has raised interest rates in an effort to combat the inflation that has been galloping out of control.

Bitcoin has so far responded to each increase in interest rates with volatility, often moving downward. Also falling during the previous several months are stock prices. Even more reliable investments like gold and silver have declined since their most recent high. The US dollar has also been rising, hitting multi-year highs versus the British pound and the euro that are also records. As long as the Fed continues raising interest rates, according to Kiyosaki, this tendency will continue, which means that BTC, along with gold and silver, might lose even more value relative to the dollar.

However, he said that this is a “buying opportunity,” and whenever the Fed “pivots and cuts the interest rates like Englang just did,” investors who buy such assets now would grin.

Assessing the Dollar Strength this Year

According to Trading Economics, over the last year, the GBP/USD, EUR/USD, and Japanese yen/USD have all shown a progressive increase in the U.S. dollar’s strength relative to other important world currencies. A 55% decline in the market value of cryptocurrencies over the last 12 months has occurred at the same time as the Fed raising interest rates and the USD rising.

CK Zheng, the co-founder of the hedge firm, predicted last month that BTC will see “extremely tumultuous” trading in October. “October is a highly volatile month, particularly when high inflation is present, and there is a lot of discussion about the Fed and changing policy. The worry is that the U.S. economy may really enter a severe recession if the Fed tightens monetary policy excessively.