Many cryptocurrency enthusiasts simply begin investing in cryptocurrencies without a plan in place. A lot of us have been there. The excitement of investing in crypto with hopes of making a huge gain with a meager investment. However, they should be aware that having a plan is crucial when starting to invest in cryptocurrencies. You’ll have a clear overview and be less vulnerable to the significant price swings in the cryptocurrency market if you stick to your plan.

For crypto traders, volatility is a fact of life. It determines if a crypto portfolio goes to the moon or gets rekt. However, there is an old trading strategy that is the best way to trade cryptocurrencies. I’m talking about dollar-cost averaging (DCA). This is a classic trading strategy in which you make regular smaller investments at intervals rather than put all your money in one crypto at once. In this article, we will talk about dollar-cost averaging, what makes it the best trading strategy for investors, and how you can DCA into huge profits.

Dollar Cost Averaging Explained

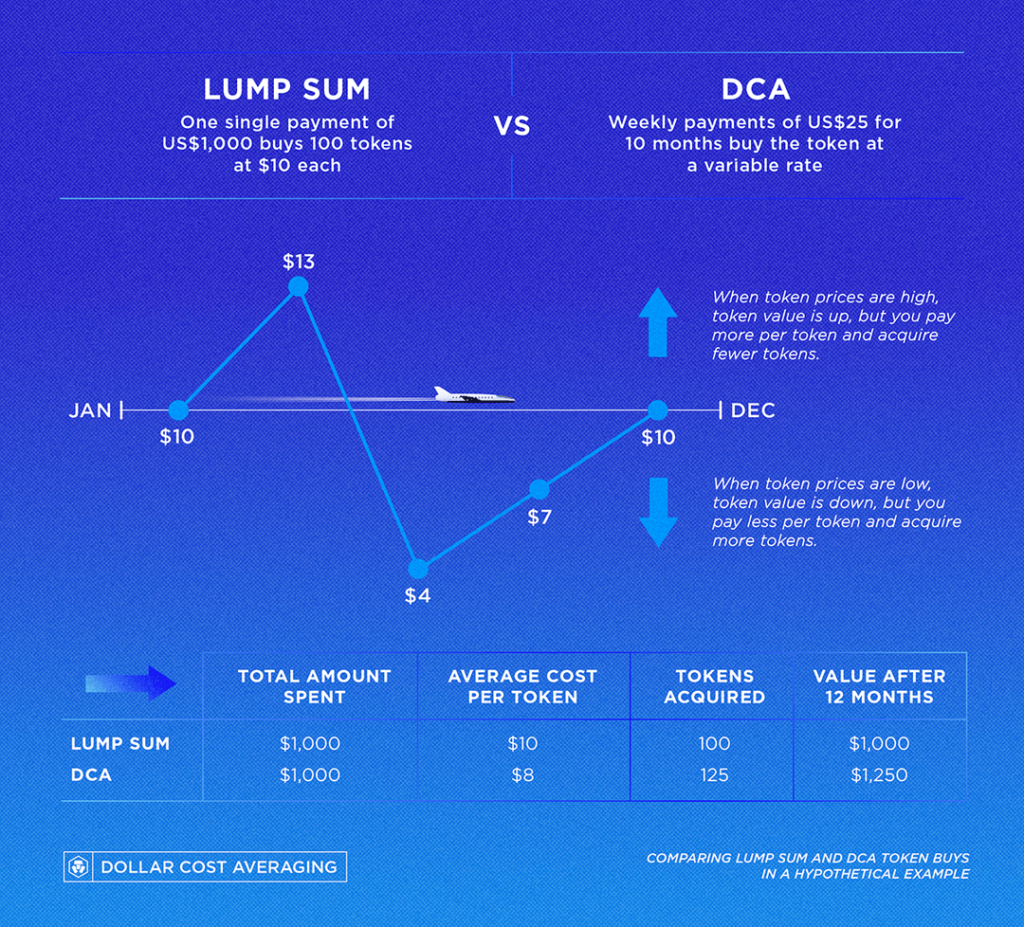

Dollar cost averaging (DCA) is the process of investing a certain sum of money into an investment portfolio regularly, usually monthly or even biweekly. If you have a 401(k) retirement account and make contributions with each paycheck, you’re already practicing dollar-cost averaging.

You avoid “timing the market” by doing this gradually and spacing out your investments. Timing the market involves investing all of your capital at once, which may be risky if you choose to do so at a coin’s all-time high. You run the risk of suffering a big loss if the project, stock, or cryptocurrency declines from that point or falls to an all-time low.

Before crypto trading, traditional investors used this strategy on stocks. It is a good trading strategy because you can diversify your wealth across multiple crypto assets rather than put all your eggs in one basket. No one wants to invest all their earnings in one particular cryptocurrency and get rekt from an all-time low. So how does dollar-cost averaging really work?

When using dollar-cost averaging, you first choose the overall amount you want to invest and the investment product(s) you want to use, such as stocks, cryptocurrencies, commodities, etc. Then, over a certain period, you invest the money in smaller, equal amounts rather than all at once.

You can arrange your DCA transactions manually, but several tools can execute it for you, such as 401(k) programs and some dividend reinvestment plans. Once configured, your purchases happen automatically, irrespective of asset price or market movement.

When you use the DCA method, you also have to remember that you may buy your crypto during bear runs. This could be during a market sell-off when a significant number of assets are liquidated quickly. So when other investors are scared of investing during this period, you will still be investing as the DCA method doesn’t consider a bear or bull run. From another angle, however, purchasing during a bear market offers you the chance to acquire potentially valuable assets at deeply discounted rates that may be distinct from those in your DCA plan. Dollar-cost averaging may enable you to gain from buying cheap and selling high by purchasing when others may be selling.

Why is Dollar Cost Averaging the Best Investment Strategy?

Yeah, we’ve talked about dollar-cost averaging and how it works. It’s time to meet the elephant in the room. What makes dollar-cost averaging the best trading strategy? Why is it the best especially for crypto traders?

Well, one aspect of crypto that people love is its asymmetric nature. What does this mean? This means that the risks of investing in crypto and the gains are not symmetrical. Whatever you invest into a crypto asset is what you stand to lose. However, the profit you can make from that single investment cannot be underestimated.

Let’s say you decide to invest $50 into a cryptocurrency. What you stand to lose is just $50. However, based on the crypto asset and other factors, you can make a profit above $500 with that single investment. You can turn a small investment into a huge profit but only stand to lose whatever you invested in.

Let’s go back to 2019. Imagine you made a net worth of $10,000 monthly and you decide to invest 5% of your net worth in crypto. You only stand to lose $500 if you do so. What if you invested $500 in Binance Coin in January 2019? Today, your investment would be worth $28,046. An amazing +5,509.29% increase. That’s a huge ROI from just 5% of your net worth.

Let’s take a look at a few calculations. Not everyone loves Maths, I know 😆. I promise this is the last set of numbers you will see.

Imagine if you invested your $100 on Bitcoin regardless of the price every month starting from January 2019. What will that look like today? Over 46 months, you would have made a total investment of $4600 in Bitcoin. Today, your Bitcoin value would be worth $7738. And this is huge considering the red zones the crypto market has seen over the last few months.

That right there is the beauty of DCA in combination with the asymmetric nature of cryptocurrencies. Dollar-cost averaging is an exciting trading strategy to use if you’re new to crypto trading or do not want to dive into futures trading. Now if you’re wondering how I got those values and would try it out yourself, here’s the link to the DCA calculator.

Dollar-cost averaging’s main benefit is that it reduces the detrimental impact of investor psychology and market timing on a portfolio. By committing to a dollar-cost averaging strategy, you reduce the risk of making unwise choices out of greed or fear, such as purchasing more while prices are rising or dumping all of their holdings in a panic when prices are falling. Dollar-cost averaging compels you to concentrate on making a certain amount of contributions every month while disregarding the price of the target investment.

Who Should Use the DCA Method?

I know I talked about crypto newbies in the intro of this article but is dollar-cost averaging limited to just new investors? Who should use dollar-cost averaging as an investment strategy?

Any investor who wants to benefit from the advantages of the dollar-cost averaging investment strategy, including a potential lower average cost, automatic investing over time, and a strategy that relieves them of the stress of having to make purchase decisions quickly when the market is volatile, is welcome to use it.

New investors who lack the knowledge or experience to determine the best times to purchase may find dollar-cost averaging to be extremely helpful. For long-term investors who are dedicated to making regular investments but lack the time or desire to follow the market and time their orders, it may also be a solid approach.

When to Use Dollar Cost Averaging

We’ve established the benefits of dollar-cost averaging and why you should use the DCA strategy when investing in crypto. However, are there specific situations where you need to DCA into an investment? When should you use the dollar cost average method?

You can join a market securely with the aid of DCA, begin to profit from long-term price growth and balance off the danger of short-term price declines. However, in situations such as the ones listed below, DCA can provide you with more predictable profits compared to making a large investment all at once.

- Hedging Trades with Volatility: Investors are exposed to prices over time with dollar-cost averaging. When the market is volatile, DCA can help you to average out any sharp gains or declines in your portfolio while also making small profits from price movement in both directions.

- Investing for the Future: DCA is extremely useful when you’re investing in a project for the long term. You can use the DCA method if you’re confident that the price of a coin is about to go down but will likely recover in the long run. You can DCA during the period the price drops. If they’re correct, they’ll gain by being able to purchase assets for less money.

As investors, knowing when to use dollar-cost averaging can be the key difference between huge profits or losing with FOMO. However, just like every other investment strategy, there are drawbacks to using DCA as an investment strategy. What are the issues with dollar-cost averaging?

Drawbacks of the DCA Method

Dollar-cost averaging will result in higher trading expenses since many trading platforms charge a fee for each transaction. The good news is that DCA is a long-term strategy by nature, so in theory, fees should become insignificant in comparison to your potential earnings throughout two, five, or 10 years and beyond.

The main disadvantage of DCA is the potential for missing out on a sizable gain that you might have made if you had invested in a lump amount during a down market. Even experienced investors sometimes struggle to anticipate intraday, or even weekly, changes in a stock or the market as a whole. However, any significant windfall gains depend on timing the market accurately. Investing in DCA may be a safer approach to profit from significant market declines.

Another drawback is that you can purchase after a sharp increase in asset prices and then experience a subsequent negative correction. Over time, a DCA approach often entails purchasing assets at any stage—whether they are stable, depreciating, or gaining. A DCA method often reduces risk and performs better over a long time horizon when used regularly.

How to Dollar-cost Average

You may manually set up dollar-cost averaging for your account or you can have it done automatically. If you choose the manual method, you will simply choose a regular timeframe (monthly, biweekly, or weekly), consider some factors, and buy your crypto on a set day.

Here are the steps to set up dollar-cost averaging for your portfolio.

1 – Decide What You’re Investing In

You must first decide what you are purchasing. Do you want to purchase stocks? Or are you going to choose a mutual fund or exchange-traded fund (ETF)? In the case of cryptocurrencies, what crypto project do you want to invest in? Ensure to make adequate research before making an investment choice. If you want to know how to effectively DYOR, here’s an article that explains how to research a crypto project.

2 – Choose a Crypto Exchange

Now you might be wondering why your choice of crypto exchange is important. Well, transaction fees play an important role in how much profit you make when dollar-cost averaging. Different crypto exchanges have different transaction fees on crypto deposits and how high or low the transaction fees determine how much you end up investing any time you buy crypto on that platform. So take your time to know which crypto exchange offers the cheapest transaction fee. In addition to transaction fees, the security of that exchange is crucial. You don’t want to store your crypto on a platform that is susceptible to hacks and theft.

3 – Estimate Your Financial Capacity

Now that you have chosen your preferred crypto exchange, it’s important to determine your monthly investment capacity. You should be able to leave your money in an investment for at least three to five years with any exchange.

Try to give the investment some time to develop and overcome any temporary price losses since most cryptocurrencies may change greatly over short periods. You will thus need to be able to survive solely off of your cash reserves at that period.

Calculate how much you can invest from your net monthly income. How much can you invest after taking care of important bills and expenses? It’s crucial to start contributing consistently, even if the amount is little at first. Since trading fees on most exchanges are now low, dollar-cost averaging is now more affordable than ever. This proves that you may start developing your nest egg with any amount of money.

4 – Start Your DCA Strategy

Now that you have everything in place, it’s time to start investing with DCA. You can set a reminder on your devices to help you buy small portions of your favorite cryptos on a set date so you don’t miss out due to busy schedules.

Conclusion

For crypto newbies, dollar-cost averaging (DCA) is a simple approach to increase your position in the cryptocurrency market. Employing DCA may help you leave your worry at the door if you find yourself hanging onto your assets because you are unsure of whether it is the perfect moment to return to the market. It doesn’t matter if you’re a newbie or an experienced investor, one cannot deny the massive potential of using dollar-cost averaging to invest in a crypto project. You can sit back and enjoy the view as you periodically invest in your favorite crypto project during any season.

Dollar Hedging your bets is the main goal of dollar-cost averaging; it limits your upside potential in an attempt to reduce prospective losses. It attempts to lessen your risks of suffering major losses to your portfolio due to short-term market volatility, making it a potentially safer option for investors. If you’re interested in learning more about crypto trading and the different trading strategies you can use, do visit Bulls Gazette regularly.