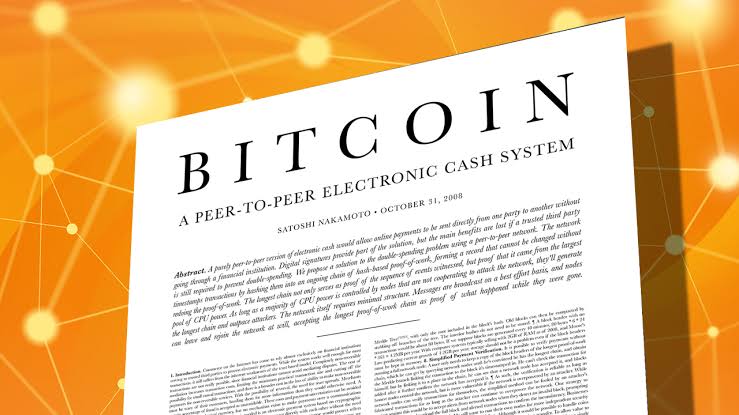

“I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.” Those were the words pseudonymous Bitcoin creator Satoshi Nakamoto used to greet the world some 14 years ago in an email releasing the Bitcoin white paper. Nobody still knows who Satoshi is now.

The first document to lay out the fundamentals of a cryptographically secured, trustless, peer-to-peer electronic payment system that was fundamentally intended to be transparent and censorship-resistant as well as return financial control to the individual was the Bitcoin white paper, which is a technical description. At that time, excessive financial market speculation and banks putting millions of dollars worth of depositors’ money at risk led to a global financial catastrophe.

This article laid the groundwork for what is largely regarded as the first usable digital money, supported by blockchain, a distributed ledger technology.

The fact that Satoshi’s electronic payment method fixed the long-standing “double-spend” issue that afflicted cashless spending was one of its many groundbreaking features. It was no longer feasible to spend the same cash twice thanks to the installation of time-stamped transactions that are unanimously validated by a distributed network of validators.

In 2008, the white paper was made available under an MIT public license for everyone to read, use, and enjoy. Read the white paper about Bitcoin here.

50% of Young People Want Bitcoin in 401(k)

A growing interest in the developing digital asset market was found in a recent study conducted by the American asset management Charles Schwab, which surveyed around 1,100 401(k) retirement plan members between the ages of 21 and 70.

When asked what investment options they would want to see included in their (401k) retirement plan, almost 45% of millennials and 46% of Gen Z said they “desire” to invest in cryptocurrencies. According to the poll, 43% of Gen Z and 47% of millennials had already made investments in cryptocurrencies outside of their 401(k) plans, which Charles Schwab noted as a sign of the generation’s interest in the asset class.

Gen Z and millennials have a burgeoning interest in cryptocurrencies, which contrasts with the opinions of considerably older investors represented by Gen X and baby boomer respondents.

According to the research, just 31% of Gen X respondents and 11% of boomer respondents want to include cryptocurrency assets in their 401(k) plans. The fraction of these older investors who already own crypto assets is even more depressing, with 33% of Gen X investors confessing to possessing crypto, compared to a pitiful 4% of boomers.

As investors continue to search for safer investment vehicles to protect themselves from unfavorable economic conditions, the study also revealed that increasing inflation continues to be the top obstacle to retirement for all investors.

Institutions have started offering opportunities for customers to integrate cryptocurrency into their retirement plans as more investors are becoming interested in digital assets.