Global Macro Updates

You may have noticed that recently our insights have been focused on the Fed and macro-economics instead of crypto. This is because we want our members to be informed about the global economy which affects everything in our lives including crypto.

Federal Reserve

-

- September drop in household spending largest in series history

-

- Fed’s Kashkari doesn’t see a stop at 4.5% or 4.75% if there is no core CPI improvement (current 3-3.25%)

-

- Fed’s Bullard sees the Fed moving the 2023 tightening into 2022 (increasing the pace of interest rate increases)

-

- Fed’s Evans claims the Fed is facing a difficult messaging problem as it nears a decision to halt the pace of rate hikes

-

- Fed’s Harker claims that the Fed has made disappointing progress in lowering inflation

-

- Fed’s Daly claims we are at or near a neutral rate (meaning the point of no rate increases/decreases)

-

- Oxford Economic’s Head of US Economics Kathleen Bostjancic claims that the equity market keeps jumping ahead to the last pivot, and we’re a long way from the Fed cutting rates

-

- US Treasury weighing buying back bonds (Currently the Fed stopped buying Treasury bonds, which is part of their quantitative tightening policy causing Treasury bills to tank. The Treasury wants to buy its own old bonds and issue new ones in a bid to add liquidity. It is hard to see how that would work without engaging in money printing)

-

- US September budget outlays an increase in spending from $524Bn in 2021 to $917Bn, meanwhile, receipts rose from $460Bn to $488Bn (Meaning the US government has spent twice its income in September of 2022, adding the deficit to the national debt)

European Central Bank + Bank of England

-

- Bank of England doubles its temporary QE (doubled the rate of money printing), then proceeds to end it

-

- Germany announces a 200Bn Euro stimulus to “fight” inflation (printing money causes inflation)

-

- France plans to spend 100Bn Euros on stimulus between 2021-2023

-

- Eurozone CPI (official inflation) reaches 10% Year Over Year

-

- Producers Price Index up 46% in Germany (now costs 46% more to produce the same goods compared to last year

-

- German parliament votes on removing the debt ceiling

-

- UK treasury bails out Bank of England’s £11Bn QE losses

-

- Eurozone inflation reaches 9.9%

-

- UK inflation reaches 10.1%

Bank of Japan

-

- For 4 trading days Japan’s 10-year bonds were not traded due to a lack of buyers for the first time in history

-

- BMO Global Asset Management’s Earl Davis claims that Japan could cause the next bond hurricane

-

- Bank of Japan announces they will conduct emergency bond buying as key yield broke ceiling (note that BOJ currently owns 70% of local 10-year bonds and 63% of local ETFs)

-

- Bank of Japan’s Kuroda says it’s appropriate to continue monetary easing (essentially printing money)

-

- Japan’s economy minister Yamagiwa plans to step down

-

- The total size of Japan’s stimulus package is likely around 67.1T Yen -Kyodo (equivalent to around $455B; Japan’s central bank is trying to push liquidity into the Japanese market to prevent a financial crisis, but by doing so creating runaway inflation)

Macro Analysis & The Sovereign Debt Bubble

What we are seeing here, as per the information above is the unfolding of the global sovereign debt bubble, where central banks are beginning to fold from the rising interest rates which are causing turmoil in the bond market, essentially cutting off the government’s lifeline of selling bonds to private entities. These central banks are folding by monetizing debt, which causes a spike in inflation. Debt monetization is when a government borrows money (essentially printing money) from its central bank to inject liquidity into markets, and by doing so causing inflation. Bank of Japan has already started its debt monetization causing the Japanese Yen to reach new all-time lows of 152 JPY against the dollar. Although the UK hasn’t completely folded yet, we see that it has already started the first steps in debt monetization, making it only a matter of time before they restart its money printers. We expect the European Central Bank to last longer than the UK before also folding into a quantitative easing policy. The main ramification of the sovereign debt bubble bursting, and governments monetizing debt is the creation of runaway inflation over the next couple of years, greater than what we are currently experiencing. If you’d like to learn more about how to preserve & grow your wealth during this upcoming financial crisis, head over to our Members Area and read “The Gold Bull” & “The Bitcoin Bull” signals.

US Economy & Crypto Outlook

While the USD does not necessarily get affected by the sovereign debt bubble, it does not mean it is safe or wise to park capital into. The latest September data shows that Retail Sales (RS) came in at 0.0% MoM, expected 0.2%; Consumer Price Index (CPI) came at 8.2% YoY, expected 8.1%; Core Consumer Price Index (Core CPI) came at 6.6%, expected 6.5%; Producer Price Index (PPI) came at 0.4% MoM, expected 0.2%; Non-Farm Payroll (NFP) came at 263K, expected 255K; Personal Consumption Expenditure (PCE) came at 0.6% MoM, expected 0.5%. All of these indicators show that while the Fed keeps pushing for higher rates, it is still failing at bringing down inflation at a fast rate. This indicates that the Fed won’t pause or end its rate hikes for a long while (at least till we see CPI decreasing at a steady rate due to the tightening policy and not due to decreasing oil prices). At the current rate stocks, bonds, and real estate will continue to get hammered making new lows after every rate hike or pause since the market anticipates rate decreases starting in December (which we don’t believe will be the case). Whether the Fed keeps hiking the rate or lowering it both options lead to a financial crisis with the latter being runaway inflation. Our current strategy of accumulating precious metals & crypto should be a sufficient hedge against the Fed failing its soft landing of the economy.

Technical Analysis

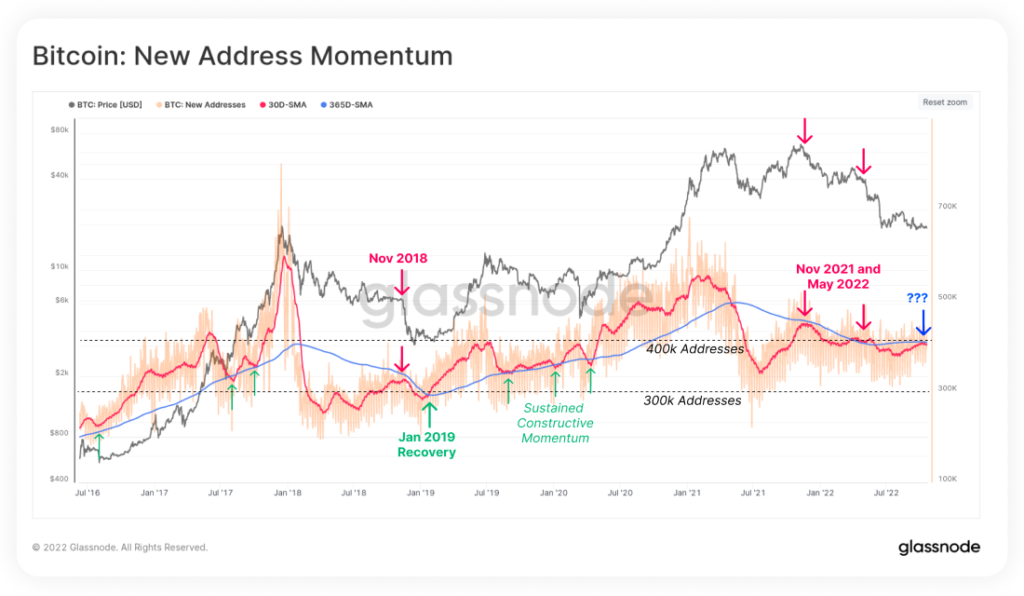

We’re seeing ourselves in a seesaw movement as Bitcoin remains within the $19k-22k range. The end of the huge descending triangle approaching, meaning it could be time for an impulsive move.

Disclaimer: Not financial advice. Please do your research before investing.

Given this sideways movement, a rise to $22k wouldn’t be unexpected in such a market sentiment. It does however, give enough support for us to increase the bottom target to around $14.5k (if $17k breaks) where BTC completes the Wyckoff Distribution and finally be in capitulation.

Whilst the trend is generally downward, we’ve hit the weekly moving average line, and on an hourly chart: a descending broadening wedge that has a resistance around $19.2k which may be flipped into a support – our chance at getting off this seesaw. Until then, we remain with serious FUD at a time where crypto companies have filed for bankruptcy, made multiple layoffs and are just not able to prove their fundamentals.

Market Digest

News Updates:

-

- Ethereum Merge Completed

-

- FTX Acquires Voyager Digital $111m

-

- Kraken CEO Jesse Powell Resigns

-

- South Korea issues arrest warrant for Do Kwon

-

- CME offers ETH Options

-

- Former Meta execs raise $300M for Sui blockchain

-

- Paypal introduces misinformation fine then removes next day after backlash

Bitcoin opened September at 20k and closes on a minor 5% decrease at 19k. The 18.5k support seems to be holding for now but there’s always a chance it can break it and see a lower floor before consolidating. Bitcoin did have a huge pump in the middle of the month going from 18.8k to 22.5k. This was likely due to MicroStrategy’s (one of the most prominent Bitcoin whales) intent to sell up to $500 million in stock, with the proceeds going toward buying Bitcoin. Expecting the rest of Q4 to play out this way though see our technical analysis for more in-depth insight.

FTX Acquires Voyager Digital

FTX, one of the largest Exchanges that recently acquired block folio now has officially bought out the assets of bankrupt Voyager Digital. Voyager Digital, a Canadian-listed crypto lender that filed for bankruptcy in late July had protected investor’s funds by the Federal Deposit Insurance Corporation (FDIC). Almost 60% of their loan book was composed of loans to the now Bankrupt 3AC Three Arrows Capital. FTX will pay Voyager $1.42 billion, an 8% premium to the market value of the assets, in an attempt to retain the customers to open accounts with FTX.

Paypal introduces misinformation fine then removes next day after backlash

PayPal received major backlash after it published a policy update penalizing customers from using its services for activities identified by it as “sending, posting, or publication of any messages, content, or materials” promoting misinformation. PayPal’s policy stated that a $2,500 charge was to be paid for each violation.

PayPal then retracted this policy claiming that it was sent in error. PayPal shares were down over 5% after the update and received many negative views on social media over the weekend. “A private company now gets to decide to take your money if you say something they disagree with. Insanity” Marcus CEO of Bright spark tweeted with the likes of Elon Musk supporting his view.

Former Meta execs raise $300M for Sui blockchain

Mysten Labs, The growing blockchain company founded in 2021 by former execs at Meta have raised $300million in series B funding for their layer-1 blockchain Sui for the building of its core infrastructure and accelerating the adoption of its ecosystem.

Sui blockchain is a proof-of-stake layer-1 blockchain that uses a revolutionary feature called “transaction parallelization” for low latency transactions and low transaction fees with high throughput, Sui will likely be a key competitor against the likes of Ethereum and Solana.

Evan Cheng, Mysten co-founder, and CEO said “This new funding will enable Mysten to continue to scale Sui, and we are grateful for the support from blue-chip investors and strategic partners who are aligned in our mission.”

The funding led by FTX Ventures raised $300 million. Other Series B investors included Coinbase Ventures, Jump Crypto, Circle Ventures, and Binance Labs, with the new capital valuing the company at over $2 billion.

Sign in to read the full article

(It’s FREE!)

The Future of Economics

Access the latest market insights, technical/fundamental analysis, special reports on finance, crypto, digital assets and much more.

Join NowSign In