Here We Go

The annual Consumer Price Index (used to calculate inflation) declined from 9.1% in June to 8.5% in July, thanks to falling energy prices. Consequently, S&P500, NASDAQ, and Dow all rose by over 1%. U.S. non-farm payrolls (jobs increase or decrease) rose up by 528k from 398k in June. Additionally, yearly wages sit unchanged at 5.2%. The Bureau of Labor Statistics announced that the Unit Labor Cost (how much a business pays its workers to produce one unit of output) increased by 10.8% in the second quarter of 2022.

It is puzzling how the job market is holding up considering the recent mass layoffs in fintech companies. A decrease in non-farm payrolls would indicate a worsening economic standing, while an increase that we have just witnessed is a sign of a strong one.

The decrease in CPI & increase in jobs is granting market participants with false hope of an economic upturn. Generally, one could also interpret the rise in jobs as a normal reaction by people who are affected by real inflation (people seeking a second job to afford the increased expenses). Tech and Wall Street companies have been experiencing massive layoffs, yet jobs have increased. Real inflation, represented by the M3 broad money supply (explained in more detail in our 1st Signal, “The Gold Bull”), is estimated to be over 40% since 2020 and still increasing due to new stimulus packages, the latest being the $790Bn “Inflation Reduction Act” which creates more inflation, whilst CPI is decreasing.

The market is assuming that the Fed is almost done hiking interest rates and that inflation is decreasing because the economy is shrinking. Almost no one is considering that we could see interest rates over 3.5% relatively soon (Currently being at 2.5%) and instead are assuming that the Fed’s deflationary policy is almost over.

The general market sentiment is that the Fed will achieve a soft landing of the economy, accompanied by lower interest rates and inflation. The market is also betting on the end of the recession with the end of hikes. The market is usually wrong.

It will take more than just a few rate hikes to undo the damage done by recklessly printing money over the past two years. Even more so to undo the damages created by the past decade’s previous “easy money” monetary policies, pouring liquidity into every malinvestment, saving it from liquidation, and artificially prolonging the dollar boom. The latter part would prolong a recession. The longer the boom, the longer the doom.

Even if the Fed commits to one more 0.75% rate hike before ending its tightening policy, which is what the market expects, the Dollar, stocks, and bonds would crash. Our portfolio of gold and cryptocurrency would be extremely bullish. Why? Because inflation isn’t going down anytime soon, and it won’t take long for the market to realize that. What would happen if the Fed keeps hiking? For starters, liquidity will rush to exit stocks, bonds, and the dollar causing a flash crash and potentially a cyclical Dollar bear, followed by the bankruptcy of the U.S. government as it won’t be able to cover its interest payments. This event would cause the greatest wealth transfer from traditional assets into safe-haven assets.

Keep in mind that you probably haven’t heard or read about any of these situations before on mainstream media, and that’s because they listen and believe the Fed, who wouldn’t show weakness in its resolve unless it is forced to. Once the non-farm payroll turns negative, increasing unemployment, the political pressures will start mounting on the Fed, forcing its hand to lower interest rates.

Based on fundamentals, both Gold & Bitcoin are cheap, while stocks & bonds are expensive. Until then, your best bet at surviving the upcoming financial meltdown is reading and following our latest TBG Signals “The Gold Bull” & “The Bitcoin Bull”

Monthly Technical Analysis

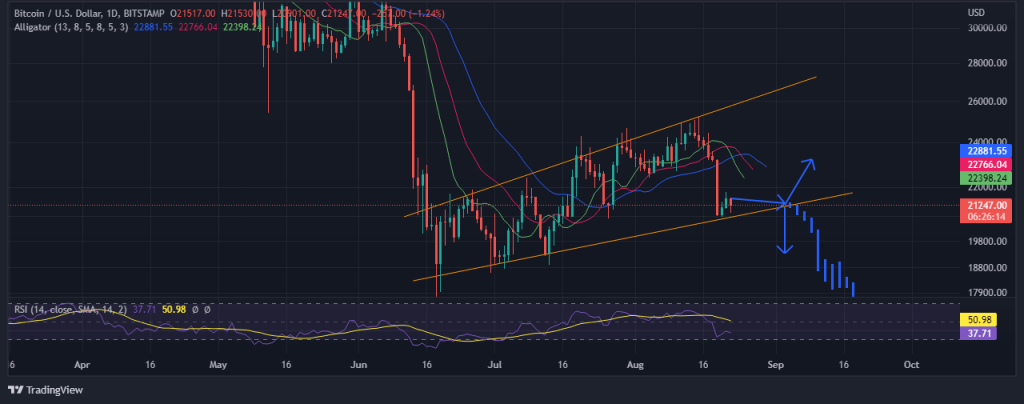

Last month we said a drop to a $15k BTC is possible. Well, you can call the current situation a start to that scenario.

As you can see in the graph, the ascending wedge broke through the support – a very bearish outlook. The $21k level is our most recent resistance as the price level just plummeted through all the 3 levels of CPR.

What happened to the bullish crossover? The consolidation couldn’t pull off a big move. When the market is stale like that for a few days, the 50 EMA easily takes over the 20 EMA yet again.

It’s looking bearish BUT maybe we won’t go that low: On a daily frame, we’re forming an ascending broadening wedge. It’s only if we break out of this (to the downside) that will lead to the $14-15k we talked about last issue. Otherwise, expect multiple retests of the 0.236 Fib line with a final dip to $19.7k.

ETH Update: The #2 crypto by market cap is expected to accumulate until just before the Merge. Read more about it here.

Sign in to read the full article

(It’s FREE!)

The Future of Economics

Access the latest market insights, technical/fundamental analysis, special reports on finance, crypto, digital assets and much more.