Mt. Gox creditors on Twitter dismiss reports about an upcoming Bitcoin (BTC) dump float on the market with one highlighting that the repayment system is not yet live and creditors will have to register their details for the repayment process.

Mt. Gox is Not Distributing any Coins

Recently there have been rumors about an impending Bitcoin (BTC) dump circulating on Twitter. Creditors of the bankrupt exchange Mt. Gox turned to Twitter to deny them all, with one tweeting that the payout system is still in development. In response to speculations spreading on social media, Eric Wall who identifies as an Mt. Gox creditor stated in a Twitter thread that there will not be a 140,000 BTC dump.

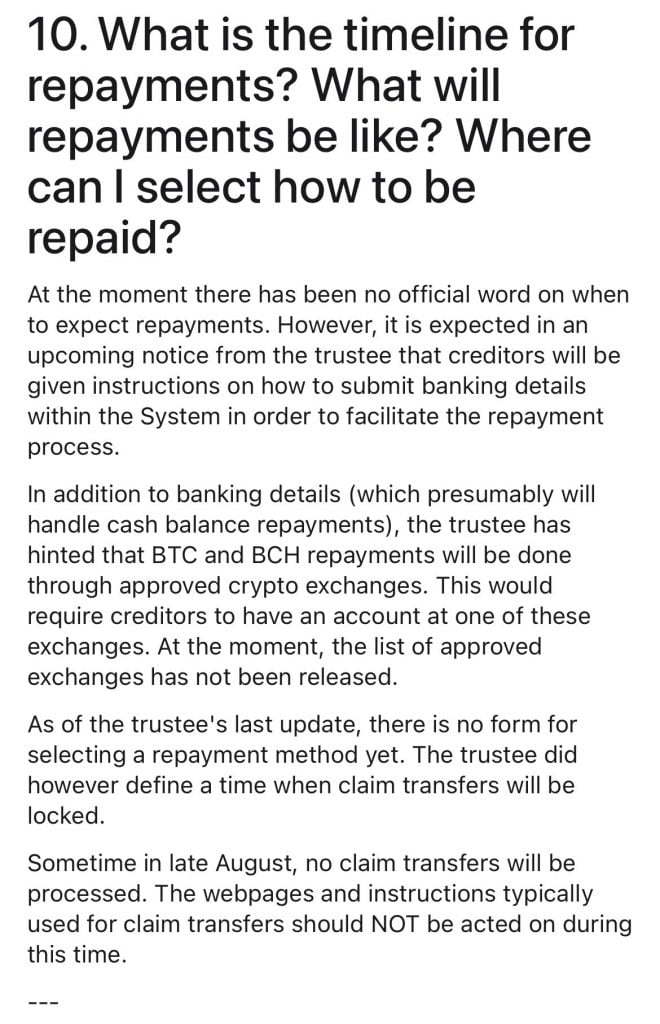

Wall claims that the exchange has not yet finished building the infrastructure required to start the reimbursement. Wall said that individuals are now still unable to register the address to which Bitcoin and Bitcoin Cash (BCH) payments should be sent. The creditor also thinks that payments should be made in several installments, putting to rest concerns that thousands of Bitcoin would be sold at once, dumping the price of Bitcoin.

Wall also noted that the crypto exchange is yet to provide a timeline for the repayment process. He added that if Mt.Gox releases the Bitcoins, he would not be selling because of the current market condition. He ended the thread expressing disappointment at the misinformation from multiple social media accounts and called for the crypto community to block accounts promoting false information.

Comments from the Crypto Community

Following this thread, other members of the crypto community expressed opinions on the issue with many stating that the distribution has not started yet. The CEO of Eight Global, Michael van de Poppe, said in a tweet that Mt. Gox is delaying the distribution again and that the uproar around the news was unwarranted.

Another Mt. Gox creditor, Marshall Hayner, reported that they have not yet received their Bitcoin. Furthermore, Hayner reassured the neighborhood that the majority of those who will receive payback from the exchange do not plan to sell their Bitcoin.

Crypto influencer Danny Devan claimed that because the assets would be distributed over months, there would not be “crazy selling” throughout the repayment process, which is just getting started. Devan was pessimistic about the massive volume of BTC being sold and anticipated that the bear market would last for a considerable amount of time.