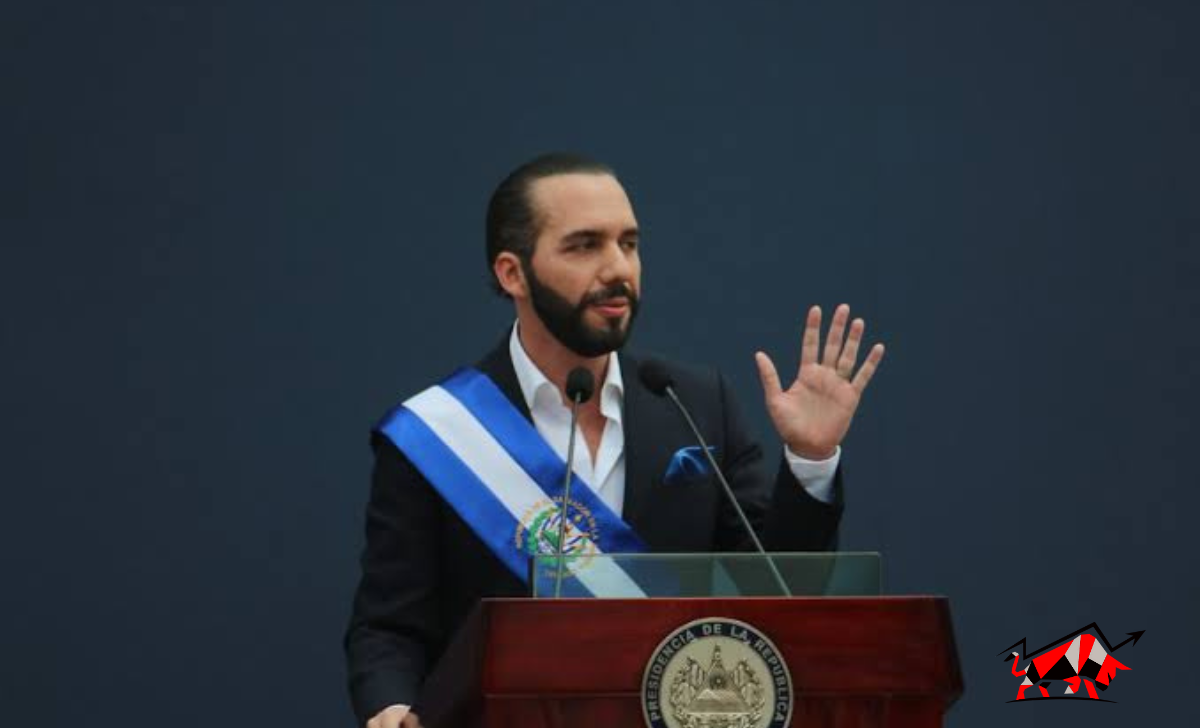

El Salvador President Nayib Bukele announced that the country would start buying Bitcoin on a daily basis from the 18th of November, 2022.

While many people have turned away from cryptocurrencies in the wake of the recent events surrounding the FTX crash, President Bukele had a different perspective. He took the chance to make a stronger argument for the use of Bitcoin after the occurrence.

“We are buying one Bitcoin every day starting tomorrow,” Bukele said in a post on Twitter. Prior to introducing Bitcoin as legal tender last year, El Salvador started putting Bitcoin on its books. The Central American country currently holds about 2,381 Bitcoin. However, at an average purchase price of roughly $43,000, it has accumulated a loss of $54.

Nayib Bukele Still Bullish on Bitcoin

After declaring Bitcoin to be legal money in September 2021, El Salvador began purchasing the currency in September 2021. At the time, BTC was experiencing a bull market, making every investment the country made appear profitable since the price was setting new records every other week. But when the bear market began to take hold by the second quarter of 2022, El Salvador’s early BTC purchases began to seem like a risky bet that cost him dearly.

El Salvador reportedly paid $43,000 on average for 2,381 BTC. As a result, the country’s BTC purchase cost close to $103.23 million, and the price of that BTC is presently $39.4 million.

El Salvador may be able to somewhat offset its losses in the upcoming months with the introduction of a new BTC purchasing procedure at a time when the most popular cryptocurrency is trading at a new cycle low. Beyond the tiny country’s losses on its Bitcoin purchases, the leading cryptocurrency has played a crucial role in considerably lowering the cost of cross-border remittances and boosting the tourism industry.

Dollar cost averaging is a method of buying bitcoin on a regular schedule as opposed to in response to market fluctuations (DCA). The benefit of DCA is that it eliminates the emotional component of decision-making, resulting in you spending less money overall over time while timing the market.