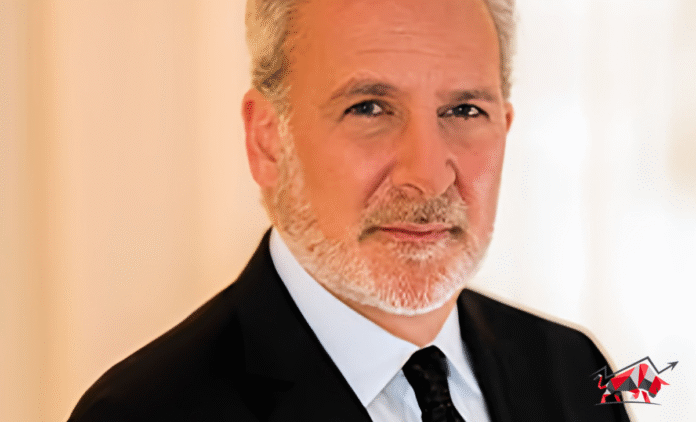

Longtime Bitcoin skeptic and vocal gold advocate Peter Schiff has once again taken aim at the flagship cryptocurrency. As Bitcoin soared past $112,000 on Thursday, Schiff used the rally to reiterate his belief in silver’s potential upside.

“With Bitcoin hitting new highs today (in dollars), it’s a great time to sell some and buy silver ahead of silver’s next big leg up,” Schiff wrote in a post on X. He argued that silver’s downside appears “very limited,” while Bitcoin, in his view, “can easily crash.”

Schiff’s comments arrive as Bitcoin continues to break all-time highs, driven by increasing institutional interest and a surge in demand amid macroeconomic uncertainty.

Arthur Hayes Flags Liquidity Concerns But Sees Altcoin Boom

Arthur Hayes, co-founder of BitMEX and a closely followed voice in the crypto space, offered a more nuanced perspective. In a Friday post on X, Hayes said he’s “slightly bearish” in the short term, citing concerns about liquidity as the U.S. Treasury replenishes its General Account through new debt issuance.

Despite these near-term worries, Hayes remains broadly bullish. He highlighted Ether’s recent strength, suggesting that the second-largest cryptocurrency by market cap could lead the next wave of gains: “[Ether] will outperform, get ready for a monster [altcoin season].”

Hayes also noted the market’s growing belief that former President Donald Trump might soften his tariff stance, a shift that could impact investor sentiment. His family office, Maelstrom, is reportedly positioning to reenter the market.

OKX Exec: Bitcoin is Becoming the Ultimate Digital Macro Hedge

Erald Ghoos, CEO of OKX Europe, emphasized the growing institutional view of Bitcoin as a macroeconomic hedge. He said Bitcoin’s recent breakout reflects more than speculation—it’s a signal of shifting global financial dynamics.

“This isn’t just noise,” Ghoos said. “It reflects [Bitcoin’s] emergence as the ultimate digital macro hedge.”

He pointed to rising geopolitical tensions, impending tariffs, and a liquidity-driven policy environment as key catalysts. “Institutions are treating BTC like a form of digital gold. With volatility at decade-low levels and strategic ETF inflows accelerating, July is shaping up to be a defining moment,” he added.

Market Outlook: Diverging Views, Common Themes

While Schiff maintains his long-standing bearish outlook on Bitcoin, both Hayes and Ghoos suggest the crypto market could be gearing up for broader gains—especially for Ether and altcoins. With institutional flows rising and macroeconomic uncertainty mounting, Bitcoin’s rally is proving to be a lightning rod for both criticism and confidence.