What goes around comes around

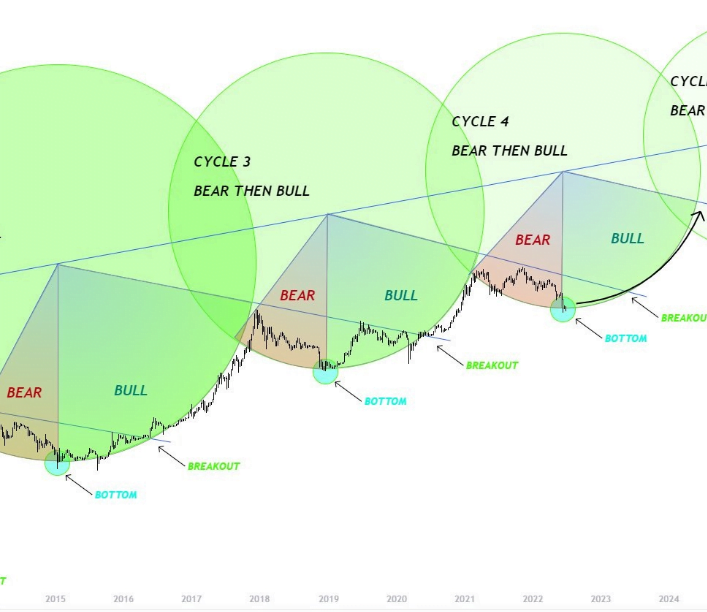

Let’s talk about the cycle before we talk about what’s next.

The Bitcoin Cycle

The Bitcoin cycle typically happens every four years with an approximate timeframe of 2-3 years of bull market and around 1 year, give or take, for the bear market. The reasoning behind this specific cycle pattern is Bitcoin’s reward halving that happens every four years, where the reward for miners successfully solving a block is halved, which in turn halves the total amount of new bitcoin being mined from that date onwards; creating a deflationary shock. The deflationary shock isn’t usually instant as it takes time for the market to absorb the already available Bitcoin liquidity before realizing the bitcoin supply to exchanges has decreased. To simplify this theory, miners mine bitcoin and are thus rewarded with Bitcoin, the miners are then forced to sell a portion or all of the mined Bitcoin to cover their electrical expenses and take profit. Miners being forced to constantly sell Bitcoin year round to cover their expenses is a constant downwards sell pressure on Bitcoin – which is why with every 4 year cycle Bitcoins reaches new highs as its sell pressure decreases significantly. We are currently around a year into the bear market and expect, from a fundamental point of view, that we have survived past most of this bear market, but more on that in the upcoming 2nd edition of our TBG Signal “The Bitcoin Bull”. Currently around 900 Bitcoins are mined everyday, a figure that is cut in half every four years with the next one being in May 2024. To put it into perspective 900 Bitcoins entering the circulation daily would require around $19M of new capital to enter Bitcoin on a daily basis to hold it’s current price; at $70k Bitcoin it would require around $63M of daily new capital to hold this price. After the next halving in May 2024 it will only require around $9.5M of daily new capital to keep a price of $21k, and $31.5M to keep a price of $70k.

Monthly Technical Analysis

The market in the last couple of weeks has seen a nice slow rise since the last bloodbath. BTC managed to break out of an ascending broadening wedge earlier this week, turning the $21.5k resistance into a support.Our price prediction up until then remained a rise to $24k followed by another dip to the $19-20k area (respectively the upper and lower CPR for July).

- Prepare for another breakout

It’s the end of the month, the edge of the CPR, the narrowing of the weekly moving averages: even a drop to $14-15k is possible.

- The graphs show clear signs of weakness (even daily); our target was to close the week above the 200 Weekly SMA but if we’re continuing this downtrend, our medium-term price target is $24k AFTER a significant dip to wherever the 300 Weekly SMA (the green line for you new folks).

- It’s a real tough time in the crypto space right now, but it is those who are patient at this time that will make the next big winners.

Market Digest

News Updates:

- Three Arrows Capital liquidates, filling for bankruptcy.

- Elon Musk pulls out of Twitter Bid

- Sri Lankan President steps down amid economic chaos

- FTX bids to acquire Robinhood

- Russia defaults on foreign Debt

- Celsius and Voyager file for bankruptcy

- Coinbase lays-off 18% of employees

Zero Arrows Capital:

Founded in 2012, Su Zhu and his classmate Kyle Davis started their own fund in their living room. They mainly traded forex currencies but later in 2018, they narrowed down to exclusively trading cryptocurrency. June saw the crash in Bitcoin’s price down to 20k and the LUNA fiasco that inevitably ended in the private hedge fund filing for chapter 15 bankruptcy. 3 Arrows Capital was reported to be heavily invested in the Greyscale BTC fund and LUNA, leading to a default on a $670 million loan. Another crypto broker, Genesis Global Trading, reported and filed a $1.2 billion claim against 3AC. The leveraged trade positions are definitely a major contributor in the company’s insolvency and are apparent in the likes of Voyager and Celsius who also defaulted.

Elon Musk pulls out of Twitter Bid:

In the last month, serious talks went down between one of the wealthiest men on the planet, Elon Musk and Twitter. At the end of April, Musk offered $44billion dollars ($54.20 per share) cash offer to its shareholders. Musk backed two-thirds of the deal’s value with his own assets, oblivious to the risk involved, Musk reported having said that the deal was important for the future of civilisation. In June Musk announced that he was backing out of the deal until twitter could prove that fewer than 5% of Twitter’s 229 million daily users are bots, an important metric to evaluate the company.

So what happens next? Twitter shareholders are due to have a meeting in September to discuss whether the deal should go through, reports indicate that Twitter is asking the Court of Chancery to enforce its agreement with Musk, bailing on the deal could cost Musk $1 billion in termination fees.

Celsius Halts Withdrawals

Another company to have been hit last month is the popular crypto lending platform Celsius. On June 13th Celsius announced that it was suspending withdrawals and transfer of funds until the company has “put Celsius in a better position to honour, over time, its withdrawal obligations” This came as no shock with the recent events in the crypto space, though a large lending platform with almost $12bn in assets is still vulnerable. The fall of companies and announcements such as Coinbase laying off 18% of its employees may allude to a potential crypto-winter.

Sign in to read the full article

(It’s FREE!)

The Future of Economics

Access the latest market insights, technical/fundamental analysis, special reports on finance, crypto, digital assets and much more.

Join NowSign In