Terra’s vision was to create an open-source financial system that would enable anyone in the world to access crypto assets, accelerating global adoption. Terra’s stablecoin, TerraUSD or UST, is (was) pegged to the US dollar.

Luna and TerraUSD are the two most known native tokens of the Terra network, developed by Do Kwon in South Korea in Jan 2018. The terra ecosystem currently contains over 100 natively built projects spanning from DeFi to NFTs. With the growth of crypto and smaller projects such as Terra getting the spotlight, Luna saw its price gain momentum rapidly. Boasting an all-time high of $116, a 23x gain in less than a year, Luna became a top coin in terms of market cap.

Whilst most stablecoins like Tether, discussed in our stablecoin guide, are usually backed by assets, others rely on maintaining the peg algorithmically. TerraUSD is one of these algorithmic stablecoins and was the 4th most popular stablecoin. It maintains the 1:1 ratio with the dollar through an “arbitrage see-saw” mechanism. What do I mean by that? TerraUSD is always supposed to be worth exactly $1. To mint a Luna Token, you burn a TerraUSD. Burning $1 worth of Luna will always give you $1 worth of Terra USD and vice versa. It’s like a seesaw, where TerraUSD is on one end, and Luna is on the other.

Where does the arbitrage come in?

If the demand for TerraUSD falls and is now worth $0.98, as we can exchange 1 TerraUSD for $1 worth of Luna, the keen arbitrager will see that you can profit from this disparity and hence pocket a 2 cent profit. As more and more people burn TerraUSD, you can see that the supply of Terra USD decreases. Basic economics and the laws of supply and demand tell us that as supply decreases, price increases, causing TerraUSD’s price to rise back to the $1 peg. Let us now assume that due to the vast influx of burning, TerraUSD rises to $1.02. Luna holders now realize that if they burn their $1 worth of Luna, they can mint 1 TerraUSD worth 0.02cents more. This seesaw mechanism maintains the “stability,”…. Though we found out that stability didn’t last for too long.

So, what caused this bloodbath?

To put it simply, the seesaw broke. TerraUSD had the Anchor Protocol, enabling UST holders to gain an alarming monstrous 20% APR – The likes of which no commercial bank can ever offer. Before the recent crash, it was estimated that 75% of all the TerraUSD in circulation was deposited in Anchor. In March 2021, Terra and Anchor replaced the 20% rate with a variable rate. This saw large amounts of TerraUSD being withdrawn from Anchor. The virtual bank run prompted massive FUD, causing groups of investors to flee from LUNA and UST. Since many people used UST as their digital savings account – the emergency exit was to burn TerraUSD in exchange for Luna. The supply of Luna ballooned, causing the price to plummet.

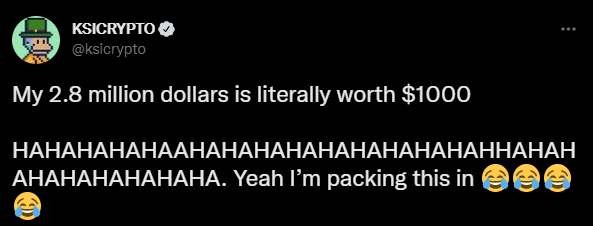

As more and more people ran to burn their TerraUSD, UST crashed, and Luna with it. The stablecoin plummeted to as low as $0.13. Luna tanked, reaching almost zero, less than a week from being $80. As of writing, Luna stands at $0.0002941 and UST at $0.1993. This is undoubtedly one of the most significant crashes we have experienced within the crypto market, sending ripples across to Bitcoin Ethereum and all underlying assets. Overall, the entire crypto market fell to $1.2 trillion from the $2.9 trillion high. Famous influencers such as KSI reported a loss of $2.8million with Reddit stories of suicides coming to light.

The crash of Luna reflects the inherent instability of cryptocurrencies and the problems that come with them. We still have a long way to go for global adoption, but if there is anything that this event has taught us, it’s the fact that even stable coins are subject to instability.