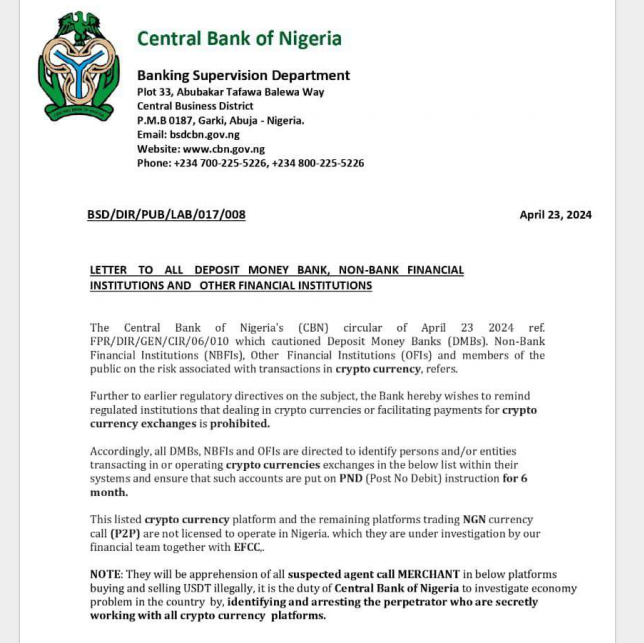

The Central Bank of Nigeria (CBN) has denied reports claiming it issued a directive instructing banks and financial institutions to identify individuals or entities involved in transactions with cryptocurrency exchanges. The alleged directive would put such accounts on a Post No Debit (PND) instruction for six months.

Understanding “Post No Debit” Instructions

A Post No Debit instruction is when a bank restricts certain transactions on a customer’s account. With a PND instruction, the account holder can’t withdraw funds or make payments from the affected account.

Initially, the central bank denied the report but later deleted the denial, causing confusion. Eventually, the CBN stated that the allegations were false.

Central Bank of Nigeria Cracks Down on USDT Transactions

The bank announced its intention to crack down on individuals illegally buying and selling Tether, especially those using peer-to-peer (P2P) methods.

The alleged circular also mentioned that regulated financial institutions involved in crypto or facilitating payments for crypto exchanges are prohibited. However, this contradicts a previous ban lifted in December 2023, allowing banks to facilitate transactions for crypto exchanges.

The central bank lifted the ban nearly two years after imposing a comprehensive ban on banks dealing with digital currencies. The decision came after recognizing the increasing global demand and adoption of crypto.

Nigerian Authorities Focus on Crypto Platforms

Due to the rapid devaluation of the naira and the subsequent high inflation rate, the government shifted its focus to platforms offering cryptocurrency services. It disabled websites associated with crypto trading known for setting informal valuations for the naira.

Binance faced significant scrutiny when the CBN raised concerns about suspicious financial transactions through Binance Nigeria in 2023.

Tigran Gambaryan, a Binance executive based in the United States, was detained in Nigeria and is facing five charges related to money laundering following a meeting with Nigerian officials about Binance’s compliance with regulations.

Nadeem Anjarwalla, another executive involved in the meeting, escaped custody and was tracked down in Kenya, where he faces extradition to Nigeria.