In the latest update from FTX Debtors, CEO John Ray has revealed that approximately $7 billion in liquid assets have been recovered thus far, with efforts to locate additional assets still underway. The complexity arising from the extensive mingling of funds has posed significant challenges for the recovery process.

The FTX Debtors, comprising the company and its affiliates, currently estimate that around $8.7 billion of customer assets were misappropriated. Notably, the majority of these funds, approximately $6.4 billion, consisted of fiat currencies and stablecoins, which were not differentiated in the exchange’s accounting practices.

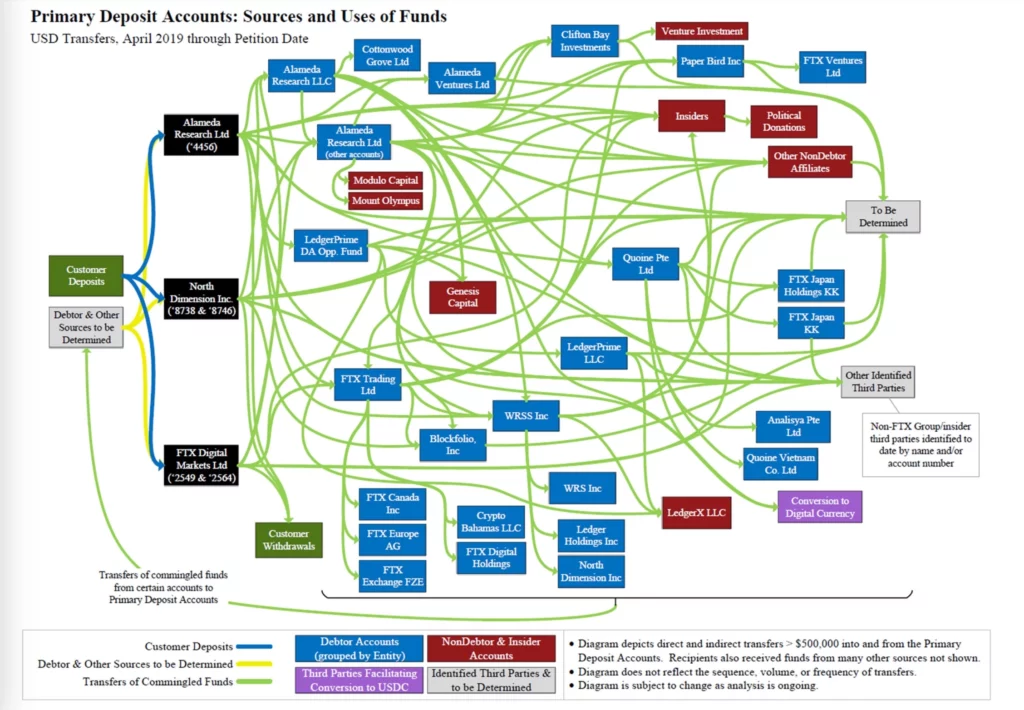

According to the report, the former leadership deliberately and purposefully engaged in the commingling and misappropriation of customer deposits. Their actions were allegedly concealed with the assistance of a senior FTX Group attorney and others. As a result, tracing substantial assets back to their original sources of funding or distinguishing between the FTX Group’s operating funds and customer deposits has proven to be an extremely daunting task for forensic accountants, asset tracers, blockchain analysts, and other experts involved in the investigation.

To highlight the magnitude of the disorder, a diagram illustrating the flow of FTX customer funds out of primary deposit accounts was presented in the report. These flows were facilitated by misrepresenting their intended purposes to banks, along with numerous other false representations.

FTX Report Sheds Light on Other Cases

The report also shed light on former CEO Sam Bankman-Fried’s deceptive statements made to the United States Congress. It repeatedly referenced the involvement of an unidentified senior attorney and noted that this attorney terminated a junior colleague who voiced objections to the company’s deceitful practices. The misappropriated funds were allegedly utilized for political and charitable donations, as well as for the company’s investments and acquisitions, including luxury real estate.

According to the report, Senior Executives, namely SBF, Gary Wang, Nishad Singh, and Alameda Research CEO Caroline Ellison, informally tracked the undisclosed liability to customers resulting from the extensive mingling and misuse of customer deposits. Their estimates ranged from $8.9 billion to $10 billion, slightly surpassing the FTX Debtors’ own estimation.

As the investigation continues, the recovery of assets and the untangling of funds remain complex tasks for FTX Debtors. The full extent of the misappropriation and commingling of customer assets is gradually coming to light, underscoring the need for transparency and accountability in the crypto industry.