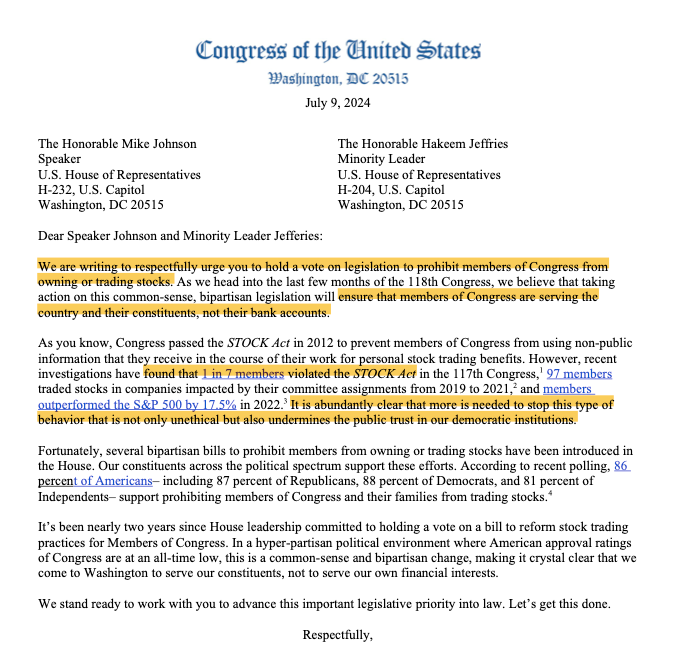

A group of United States senators from both parties is pushing to ban members of Congress from trading stocks. On July 9, they sent a letter to House Speaker Mike Johnson and Democratic Leader Hakeem Jeffries, proposing changes to the Stop Trading on Congressional Knowledge (STOCK) Act of 2012. These changes would prevent lawmakers from engaging in stock trading.

At a press conference, Senator Josh Hawley emphasized, “Congress should not be here to make a buck. There is no reason why members of Congress ought to be profiting off of the information that only they get and the rest of the American people don’t get.”

Members of Congress Influencing Stock Trades

The senators highlighted that 97 members of Congress had traded stocks in areas where their committees had direct influence. They also pointed out that, on average, Congress members had outperformed the S&P 500 by 17.5%. A recent investigation revealed that one in seven sitting members had violated the STOCK Act between 2021 and 2023.

The proposed amendment to the STOCK Act would ban Congress members from trading stocks within 90 days of the bill being signed. Additionally, starting in March 2027, it would ban the sitting president, vice president, and the spouses and dependent children of all Congress members from trading stocks.

Stricter Penalties for Defaulters

Violating the new laws would result in a fine of 10% of the value of the traded asset, a significant increase from the current penalty of $250 per violation. “It is abundantly clear that more is needed to stop this type of behavior that is not only unethical but also undermines the public trust in our democratic institutions,” the senators wrote in their letter.

Senator Jared Golden stated, “Members of Congress should be working in service of their constituents, not using their positions to line their own pockets. Anyone who feels the same should have no problem voting for this common-sense, long overdue step.”

The effort to amend the STOCK Act began in January 2022, when House members proposed changes to then-Speaker Nancy Pelosi and Minority Leader Kevin McCarthy. This push was fueled by public outrage over highly profitable trades made by top lawmakers during the early days of the COVID-19 pandemic. Notably, Nancy Pelosi faced scrutiny after reports revealed her successful trading activity contributed to her net worth growing to over $250 million, despite earning an annual congressional salary of $193,000.