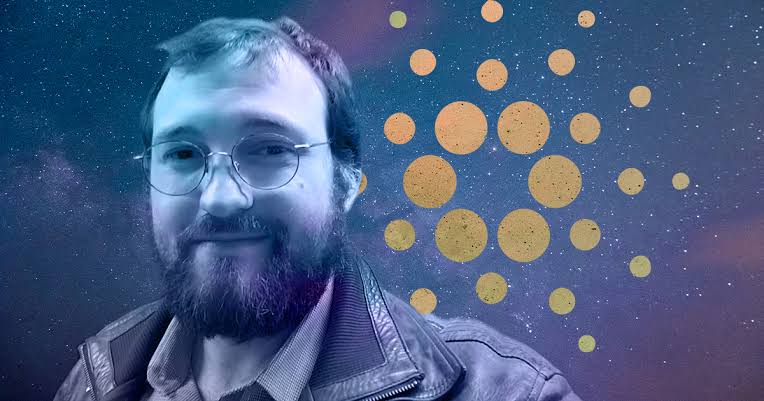

Charles Hoskinson, the founder of Cardano, says the cryptocurrency business should distinguish itself from the “unstable and erratic” financial sector. Hoskinson recently tweeted that crypto should avoid traditional banking since it is full of “unstable and unpredictable” entities. He also stated that cryptocurrency must de-risk itself from such unstable and erratic banks. He further predicted that once “we can digitize treasuries,” it will be “game over” for banks.

Regulators shut down three of America’s largest financial institutions earlier this month, Silvergate Capital, Silicon Valley Bank, and Signature Bank, causing significant losses for several crypto-focused enterprises.

Crypto Firms Lost Funds in Silvergat, SVB, and Signature Bank Crash

The recent failures of Silvergate, SVB, and the crypto-friendly Signature Bank jolted America’s financial sector. Circle was among the bitcoin startups that disclosed considerable exposure to the collapsed behemoths.

USDC, the second-largest stablecoin, with $3.3 billion locked up in Silicon Valley Bank. Soon after, the asset fell to as low as $0.87 (according to CoinGecko statistics), but quickly recovered to $1. Coinbase stated that it has $240 million in corporate cash at Signature Bank, while Paxos had $250 million exposure.

President of the United States, Joe Biden, stated earlier this week that People should have faith in the domestic financial system, calling it “secure.” He also mentioned the collapse of SVB (one of the top 20 largest banks in the United States prior to its downfall), saying that “no government losses will be incurred.”

Investors in the institution, on the other hand, will lose money since “that’s how capitalism works,” the political leader explained.