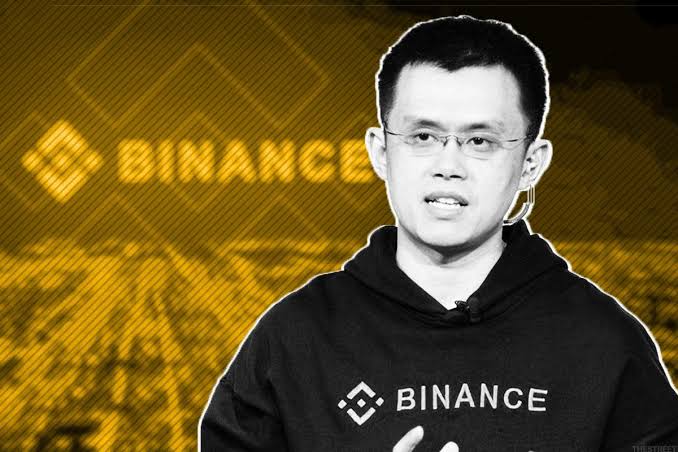

The inability of three major crypto-friendly banks – Silicon Valley Bank (SVB), Silvergate Bank, and Signature Bank – caused the stablecoin, USDC, to fall to $0.87 from its $1 peg. With the “changes in stablecoins and banks,” Binance CEO Changpeng “CZ” Zhao tweeted on March 13 that the exchange will convert the remaining $1 billion cash in its Industry Recovery Initiative to “native crypto.”

Binance CEO featured native cryptocurrencies such as Bitcoin (BTC), BNB (BNB), and Ether (ETH). He then uploaded links to the hash IDs for the BTC and ETH transactions, claiming that $980 million was transferred in 15 seconds with a $1.98 transaction charge.

In response to the move by the Binance CEO, Crypto Twitter had mixed reactions. Some praised the decision, calling it “pure gold,” and offered a suggestion to use alternative currencies to peg stablecoins:

However, others questioned the move to sell the Binance USD (BUSD) stablecoin and convert the fund to more “volatile” assets.

Related:

- Silicon Valley Bank Officially Shuts Down

- Signature Bank Gets Shutdown By Regulators Following SVB Saga

- HSBC Holdings Buys Silicon Valley Bank’s UK Unit for £1

Binance CEO Avoiding A “Circle” Situation

Circle, the business behind USDC, reported on March 10 that it had around $3.3 billion locked up at the failing SVB, which prompted the original depegging incident. Nevertheless, on March 13, USDC returned to its $1 peg, which is now hanging around $0.99.

Circle also maintains an undisclosed amount of reserve cash at Silvergate, another crypto-friendly bank in the United States that went insolvent. The volatility around USDC had a knock-on impact on other stablecoins including Dai (DAI), USDD, and FRAX, which all fell below their $1 peg. Since the events began on March 10, the crypto sector has been waiting to see what would happen next. Twitter users have claimed that there is “nobody left to bank crypto firms.