Whether you’re a crypto newbie or an experienced trader, you’ve heard of big names in the crypto world like Binance, Coinbase, and KuCoin. They’ve been the go-to exchanges for many of us. Amongst these popular exchanges is another exchange with a notable reputation — Bitget.

With a trust score of 7.2 and ranked as the 7th best crypto exchange by Coinmarketcap, Bitget is another big player in the crypto exchange industry. Bitget serves more than 20 million users in over 100 countries. It’s known for its copy trading features and a variety of smart trading tools. You’ll find a broad spectrum of services here, including trading between cryptocurrencies, spot and futures trading, margin trading, and even copy trading.

In this review, you’ll get an in-depth look at Bitget, covering everything from its features and fees to the quality of its customer support and security measures.

An Overview on Bitget Exchange

Established by Sandra Lou in 2018, Bitget is a prominent cryptocurrency exchange that offers a vast array of over 400 cryptocurrencies for trading. The exchange is based in Seychelles and boasts a global user base with more than 20 million users and a 24h daily trading volume of approximately $736 million. This makes Bitget a solid choice for both beginners and seasoned traders.

Bitget shines as one of the top 5 in derivatives volume. It’s also the leading platform in copy trading by volume. Bitget supports an extensive range of over 500 spot and derivatives trading pairs. It’s a platform that’s rapidly gaining traction, especially for those interested in strategic and copy trading. Despite being a newer player in the crypto market as compared to the bigger exchanges, Bitget allows purchases in 42 different fiat currencies through various partners. It also supports direct deposits and withdrawals in GBP, EUR, and BRL.

Bitget’s marketing efforts include high-profile partnerships and sponsorships. Notably, it sponsors Juventus F.C., Italy’s renowned football club, and is the official eSports crypto partner of PGL Major. Additionally, Bitget has teamed up with football superstar Lionel Messi.

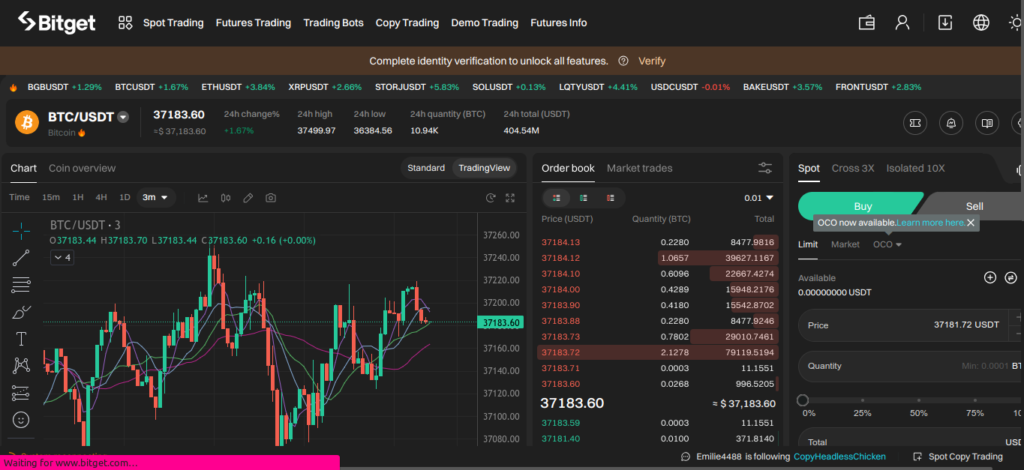

The platform, both on web and mobile, is user-friendly and well-designed. While it might seem complex for beginners due to its advanced trading features, it’s quite manageable for those familiar with trading platforms. The interface, powered by TradingView, caters to all levels of trading expertise. A notable feature is its customizable interface, allowing traders to adjust the layout to their liking, including a choice between light and dark modes.

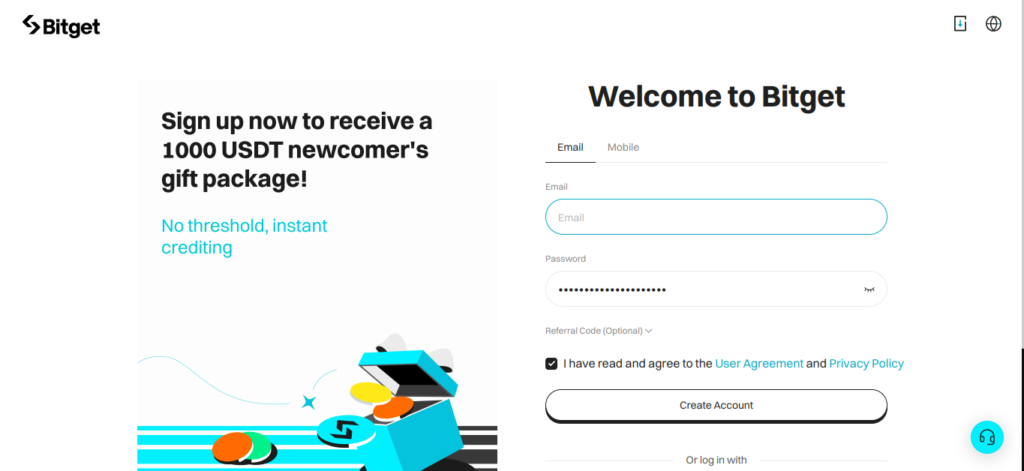

To get started with trading on Bitget Exchange, here’s what you need to do. First, create your Bitget account. Visit the Bitget website and click “Sign Up” in the top right.

You can use either your email or phone number for signing up. Create a password and agree to the terms and privacy policy.

After that, confirm your email or phone number by entering the code sent to you. This step is crucial for verifying your identity and activating your account.

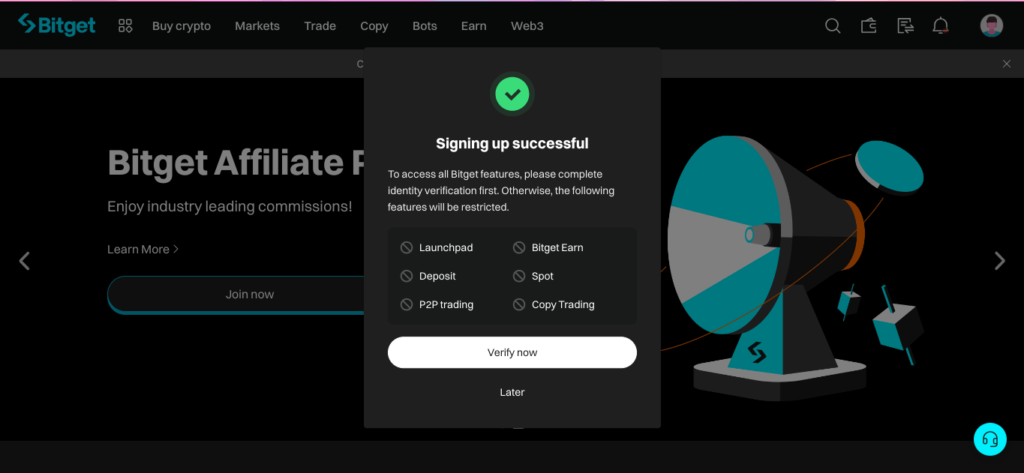

Next, you’ll need to complete the mandatory KYC verification. Bitget requires this to comply with anti-money laundering and counter-terrorism financing regulations. KYC is also important if you want to maximize your deposit and withdrawal limits on the platform.

If you haven’t completed KYC verification, you can withdraw up to US$50,000 daily and US$100,000 monthly. For those who’ve completed KYC, the limits vary based on your VIP level. As a Non-VIP, you can withdraw up to US$3,000,000 daily. VIP 1 members can withdraw US$6,000,000, VIP 2 members US$8,000,000, VIP 3 members US$10,000,000, VIP 4 members US$12,000,000, and VIP 5 members can withdraw as much as US$15,000,000 each day.

Provide your personal details like name, birth date, nationality, and identity document number. You’ll also need to upload a photo of your identity document and a selfie with it.

Once your identity is verified, it’s time to deposit funds into your Bitget account. You have various options like bank transfer, credit card, or cryptocurrency. Simply choose your preferred currency and amount, then follow the on-screen instructions.

Finally, you’re ready to buy crypto on Bitget Exchange. Select the trading pair you’re interested in, like BTC/USDT or ETH/USDT. Decide on the type of order you want to place, such as a limit or market order. You can track the details of your open and closed orders, including price, amount, margin, leverage, and profit or loss.

Pros of Bitget Exchange

Bitget Exchange stands out for its wide range of benefits, including a diverse selection of assets, competitive fees, and robust security measures. As a user, you’ll find the mobile app particularly convenient for trading on the move. The registration process is streamlined, making it easy for you to get started.

One of the key advantages of Bitget is its low transaction fees, with additional benefits for BGB token holders. The platform’s UI/UX is highly rated, offering features like direct crypto purchases, copy trading, and strategy trading.

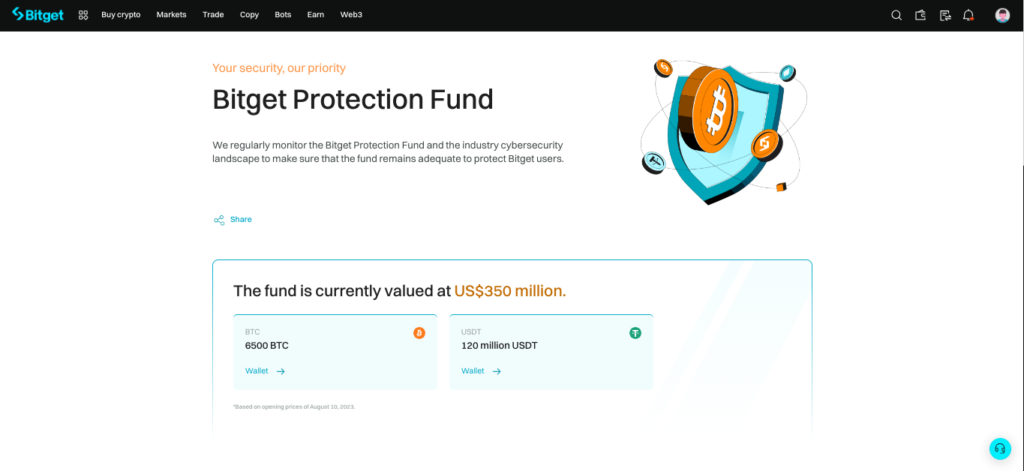

As a regulated exchange, it provides an added layer of trust and compliance. The Merkle Proof of Reserves and a substantial $300 million protection fund further enhance the security of your assets.

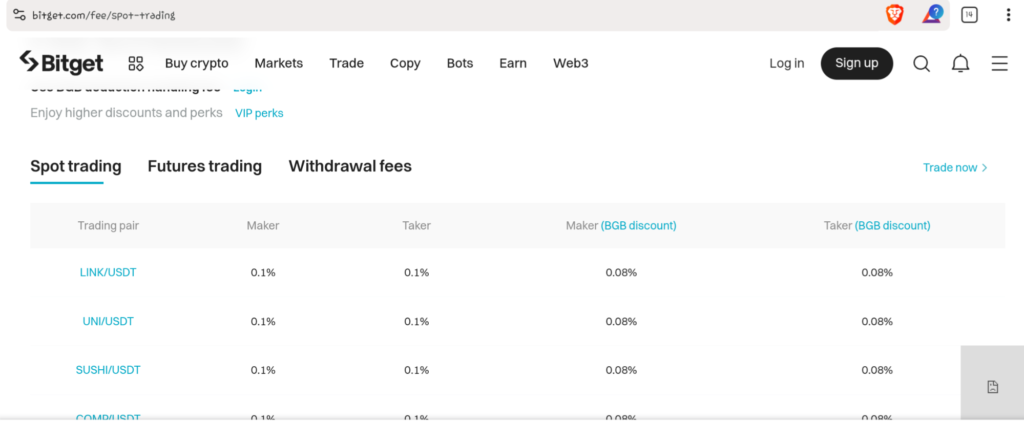

Bitget’s comprehensive crypto services include spot, leveraged trading, perpetual contracts, and copy trading. Its large user base of over 20 million is a testament to its reliability and reach. The exchange is particularly competitive in its trading fees, especially for spot trading, where both maker and taker fees are as low as 0.1% and 0.08% for users who hold its native (BGB) token.

In terms of security, Bitget doesn’t just rely on strong measures; it also has a Protection Fund to safeguard users’ funds against unforeseen issues. Lastly, the platform’s customer support team is available 24/7, ready to assist you whenever needed.

Cons of Bitget Exchange

When exploring Bitget Exchange, you’ll encounter certain limitations. One notable aspect is its restricted availability in various regions, making it less accessible globally. This limitation is particularly evident if you’re looking to use fiat currencies for transactions, as the options here are quite limited.

As a beginner, you might find the advanced features of Bitget a bit intimidating. These features, while beneficial for experienced traders, can be overwhelming if you’re just starting out in the crypto world. Additionally, for users in the United States, accessing Bitget requires the use of a VPN, as it’s not directly accessible there.

Another point to consider is the selection of cryptocurrencies available on Bitget. If you’re interested in trading low-cap or newly launched altcoins, you might be disappointed, as Bitget’s focus is more on the established cryptocurrencies.

Trading on Bitget Exchange

Bitget offers over 550 cryptocurrencies and 650+ trading pairs. The exchange’s 24-hour spot trading volume is quite substantial, amounting to $734,241,855.51. This figure indicates a high level of activity and user engagement on the platform. It’s notable for its high 24-hour trading volumes in pairs like Solana/USDT and BEAM/USDT.

This includes not just the big names like Bitcoin and Ethereum, but also a range of others like Tron, Uniswap, Solana, and Polygon. And if meme coins catch your fancy, Bitget’s got you covered with options like Shiba Inu and Dogecoin.

Before you start to trade, you need to fully understand Bitget’s deposit and withdrawal processes. If you haven’t completed KYC verification, you can withdraw up to US$50,000 daily and US$100,000 monthly. For those who’ve completed KYC, the limits vary based on your VIP level. As a Non-VIP, you can withdraw up to US$3,000,000 daily. VIP 1 members can withdraw US$6,000,000, VIP 2 members US$8,000,000, VIP 3 members US$10,000,000, VIP 4 members US$12,000,000, and VIP 5 members can withdraw as much as US$15,000,000 each day.

Fiat deposit options include EUR, GBP, RUB, UAH, and BRL, with varying withdrawal fees. Crypto transactions require considering network fees, but there are no deposit limits. Bitget sets limits on crypto withdrawals and trading fees, which are competitive in the market.

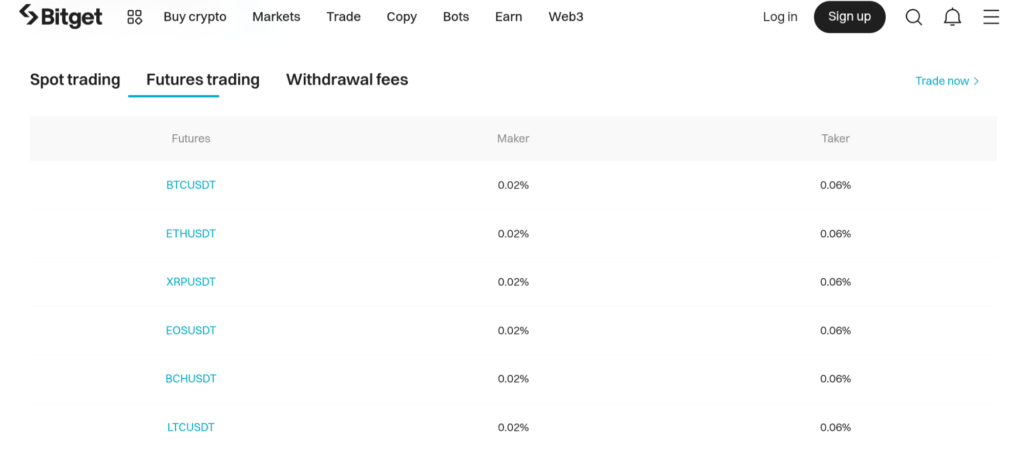

Understanding maker and taker fees is essential for trading. Makers, placing limit orders, pay lower fees for adding liquidity, while takers, executing immediate orders, pay higher fees for removing liquidity. Bitget’s fees vary by asset, with spot trading at 0.1% for both maker and taker, and futures trading at 0.02% for makers and 0.06% for takers. Using BGB, Bitget’s token, offers a 20% fee discount.

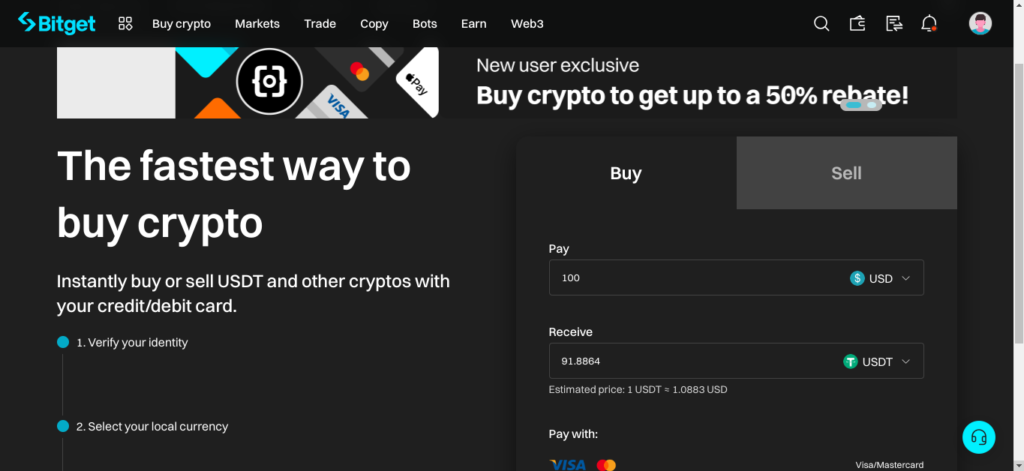

Depositing crypto on Bitget is free, but identity verification is required for all payment methods, including VISA, MasterCard, Apple Pay, Google Pay, Discover, and Diners Club. Third-party payment options like Banxa, Simplex, Mercuryo, and AlchemyPay are available, with possible provider fees. Fiat deposits are also supported via SEPA in EUR, GBP, UAH, RUB, and BRL, usually taking two days to process.

Here’s a simple guide on how to buy crypto on Bitget with fiat currencies.

To buy crypto on Bitget using fiat currencies, first, log into your Bitget account. Select “Buy Crypto” and then “Credit/ Debit card.” Choose the fiat currency you wish to deposit and the cryptocurrency you want to buy.

Pick a third-party service provider and click “Next.” You’ll need to verify your identity on third-party websites like Banxa, Mercuryo, Simplex, and Xanpool. After verification, complete the payment, which includes a fee to the third-party provider and an on-chain transfer fee. Bitget itself doesn’t charge extra fees. Once your payment is processed, which might take between two to 10 minutes, your cryptocurrency will be added to your Bitget spot account. You can check the status on the third-party provider’s website or in your Bitget account under “Asset.”

For buying crypto with crypto, it’s a bit more complex. First, log into your Bitget account and tap “Deposit.” Choose the type of coin and the specific blockchain network (like ER-C20, TRC-20, BEP-2, BEP-20, etc.). It’s crucial to select the same network as the platform you’re withdrawing from to avoid losing your assets. Bitget will then provide an address and a QR code for depositing your chosen token.

In person-to-person (P2P) trading, you trade directly with others without an exchange as a middleman. To start, click on “Buy Crypto” and then “P2P trading.” You’ll see a list of available trades with their prices and payment methods. Choose one that fits your price and payment method preferences. In the P2P section, you can buy and sell cryptocurrencies at your chosen price. After matching an order, proceed with the trade. Bitget uses an escrow service to hold funds until the trade is complete, ensuring a secure transfer of assets.

Remember, when trading P2P, clear communication with your trading partner is essential to avoid misunderstandings. Always check the trade history and feedback of users to ensure reliability. Keep your personal information confidential and enable security features like 2FA for added safety.

When you trade on Bitget, you give instructions, known as orders, to buy or sell. Let’s talk about the types of orders you can place on Bitget.

1. Market Order: This is where your order is filled immediately at the current market price. Remember, due to market fluctuations, the final price might slightly differ from the initial quote.

2. Limit Order: You set a specific price for buying or selling. Say Bitcoin is at $26,000, but you want to buy at $24,500. You set a limit order at $24,500, and when Bitcoin hits that price, your order activates.

3. Trigger Order: Similar to a limit order, but it activates when a price you’ve set as a trigger is reached.

4. Stop Loss Order: This is to prevent big losses. It automatically sells your trade if the price drops to a certain level you’ve set.

5. Trailing Stop Loss Order: It’s like a moving stop loss. Instead of a fixed price, it adjusts automatically with market changes, maintaining a set distance from the current price.

Now, let’s talk about the trading products Bitget offers and how you can start placing orders.

Spot Trading

Spot trading is the buying and selling of assets at the current market price. The assets are delivered immediately after the trade is executed. Spot trading is the most common type of trading in the financial markets.

For example, let’s say you want to buy 1 Bitcoin. The current market price of Bitcoin is $20,000. You would place a spot trade order to buy 1 Bitcoin at $20,000. Once your order is executed, you would immediately own 1 Bitcoin.

Spot trading is popular because it is a simple and straightforward way to trade assets. It is also relatively low-risk, as you are not using leverage or derivatives. However, spot trading can also be unprofitable, as the market prices of assets can fluctuate significantly.

So how can you spot trade on Bitget?

Now, let’s dive into how this works on Bitget.Assume you’ve already added funds to your Bitget account. Your next step is to navigate to the Bitget Spot Trading area.

Here, you’ll be greeted with a vast array of cryptocurrency pairs for trading. Select the pair you’re interested in. Then, enter the details for a market order or any other conditional orders you wish to place. After filling in these details, simply hit the Buy/Sell button, and your transaction is complete.

This process is similar to the car purchase, but instead of a vehicle, you’re trading in cryptocurrencies. The key is the immediacy of the transaction – you pay, and the asset is yours right away. It’s a simple, efficient way to trade, and Bitget makes it accessible and user-friendly.

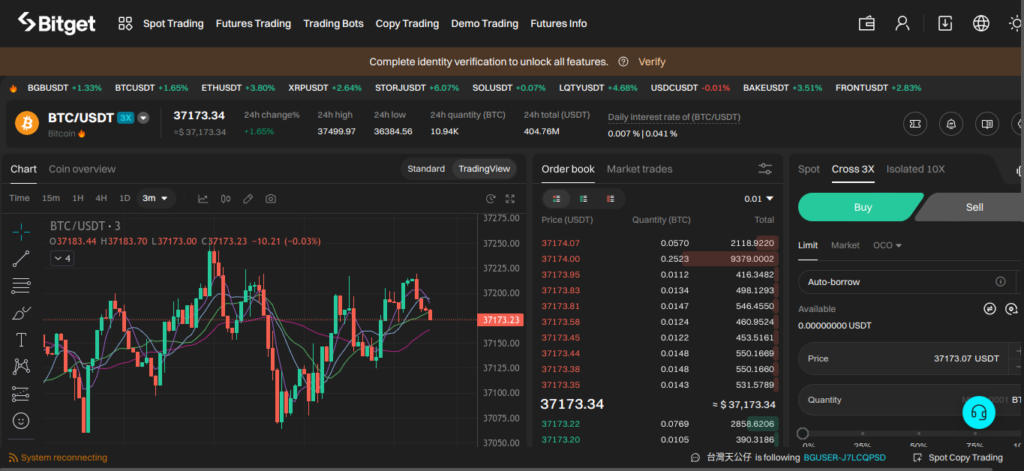

Futures Trading

Futures trading in crypto is a way to bet on the future price of a cryptocurrency without having to buy or sell the cryptocurrency itself. You do this by buying or selling a contract that obligates you to buy or sell the cryptocurrency at a set price on a set date in the future.

For example, let’s say you think the price of Bitcoin is going to go up in the next month. You could buy a Bitcoin futures contract that obligates you to buy Bitcoin at $20,000 in one month. If the price of Bitcoin goes up to $25,000 in one month, you can sell your contract for a profit of $5,000. However, if the price of Bitcoin goes down to $15,000 in one month, you will have to buy Bitcoin at $20,000, even though it is only worth $15,000, and you will lose $5,000.

Bitget has introduced Coin-Margined Futures, a novel approach to futures trading. This method differs from traditional ones by allowing the use of various currencies as margin for numerous futures trading pairs. For instance, you can use ETH as margin to trade pairs like BTC-USD, ETH-USD, EOS-USD, with your profits and losses calculated in ETH.

To start, navigate to the futures trading page on Bitget and transfer assets from your spot account to your futures account without any fees. Here’s how you proceed:

1. Open a position: Choose your trading pair and decide between cross-margin mode (using your entire account balance as margin) or isolated margin mode (setting aside a specific amount as margin).

Decide on your leverage level, enter your desired price and amount, and choose whether you believe the token’s price will rise or fall.

2. Close the position: For closing, switch to the closing operation, input your price and amount, and select the position (buy or sell) you want to close. You can close a position instantly with a flash order, bypassing the need to enter price and amount.

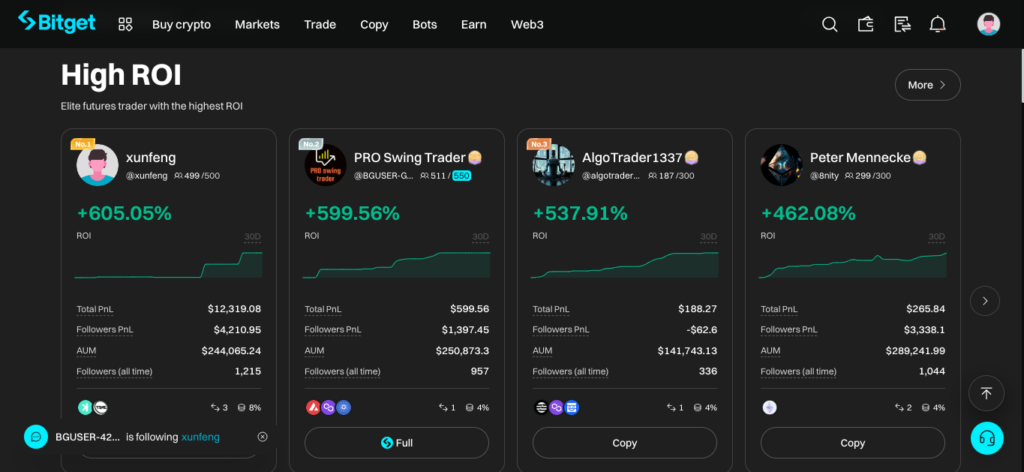

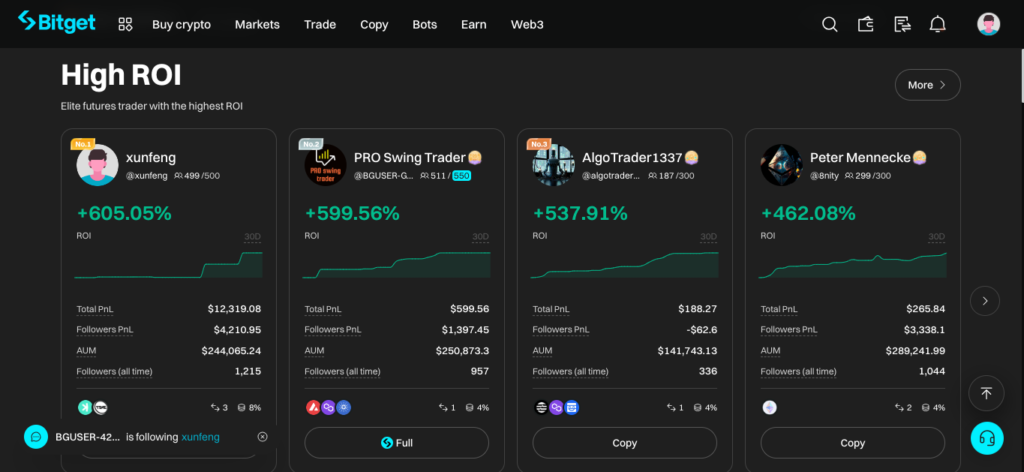

Copy Trading

In Bitget’s One-Click Copy Trade, you can start trading immediately, even if you’re new to the world of crypto and trading. This unique program is designed for those who lack the time or experience for active trading. By using this system, you can effortlessly replicate the orders of expert traders. This process is known as copy trading, where you, as a ‘Follower’, mirror the positions in the futures market of these seasoned traders. It’s a straightforward way to dive into trading, as the system handles the complexities for you.

As a Follower, you don’t need prior trading knowledge or expertise. You can develop your own trading strategy by observing and following the verified performance of professional traders. This approach allows you to manage your trades thoughtfully, adjusting them according to your risk tolerance. The system provides a transparent list of orders, giving you insights into professional trading strategies that you can adapt to suit your needs.

The process is straightforward. Visit the CopyTrade homepage, pick a trader to follow, hit “Copy,” review the details, and tailor the trades to suit your preferences.

You’re not limited to one expert; follow multiple traders and tweak your strategy whenever you wish.

Exchange Fees

The trading fees on Bitget are competitive and structured as follows:

- Spot Trading Fees: Both maker and taker fees are set at 0.1%.

- Futures Trading Fees: Maker fees are 0.02%, and taker fees are 0.06%.

- Fee Discounts: Paying fees with Bitget’s native token, BGB, offers a 20% discount.

- Deposits: Crypto deposits on Bitget are free. However, standard card payment fees apply for fiat currency deposits, and third-party payment providers may charge additional fees.

- Crypto Withdrawal Fees: These vary depending on the network and token. For example, Bitcoin withdrawals incur a fee of 0.0005 BTC.

- Fiat Withdrawals: Bitget now allows direct bank withdrawals in EUR and GBP, offering a secure and fast option with no withdrawal or deposit fees for these currencies.

Bitget VIP Program

As a crypto trader, you might find the Bitget VIP program quite advantageous. This program is tailored for active traders like you, offering a range of benefits once you meet certain criteria involving your asset holdings and trading volume. Bitget automatically grants you VIP status when these thresholds are reached, opening up a suite of perks especially for high-volume traders in both derivative and spot markets.

The program is structured into five distinct levels, each based on a combination of your 30-day spot trading volume, the assets you hold, and your BGB (Bitget Token) holdings.

One of the standout features of this VIP program is the assignment of a personal account manager. This means you get direct access to an experienced professional who can provide premium support for all your trading queries and needs on the Bitget platform.

In terms of trading fees, Bitget offers competitive rates. For spot trading, both maker and taker fees stand at 0.1%, while futures trading fees are 0.02% and 0.06% respectively. However, as a VIP, you’ll see these fees reduce significantly based on your VIP level, with maker fees potentially dropping to 0% and taker fees to as low as 0.00035%. This reduction can greatly enhance your profitability, especially when trading in large volumes.

Another perk of being a VIP is having a dedicated wallet address, which not only offers convenience but also enhanced security for your funds.

VIPs also enjoy an exclusive channel for both deposits and withdrawals, ensuring your transactions are secure, swift, and hassle-free.

Moreover, as a VIP, you’ll get priority access to Bitget promotions and exclusive perks. These include discounted fees and the chance to claim fantastic rewards in Bitget campaigns.

For those new to Bitget but already holding a VIP status with another exchange, there’s an opportunity to qualify immediately for Bitget VIP. By submitting a screenshot of your 30-day trading volume as a VIP from another exchange, you can get fast-tracked into the program. Once your application is approved, typically within 24 hours if you meet the requirements, you’ll be assigned a personal account manager, just like existing VIPs.

Services Offered on Bitget

Bitget offers a plethora of services for both newbies and experienced crypto traders. Let’s take a look at each of them.

Copy Trading

In Bitget’s copy trading feature, you have the opportunity to mirror the trades of experienced traders. Imagine you select a trader to follow; you can then allocate a specific amount of funds to automatically replicate their trading actions in real-time. This system is quite expansive, with over 100,000 top traders, 410,000 followers, and a remarkable $350 million in realized PnL reported on Bitget.

You’re presented with three distinct options in Bitget copy trading: futures, spot, and bot copy trading.

With futures copy trading, you can echo the futures orders of skilled traders. This method is designed to capitalize on the fluctuating prices of cryptocurrencies. It’s flexible, allowing you to adjust settings like leverage, position size, and even set stop loss and take profit points.

Spot copy trading, on the other hand, is all about automatically copying the spot trades of elite traders. It’s a straightforward approach to trading in the spot market.

Lastly, bot copy trading offers a more automated route. Here, you can either subscribe to a strategist’s services or purchase a trading bot. This option is tailored for those who prefer a hands-off approach, with a variety of strategies and bots to choose from based on their performance history, popularity, and cost. This comprehensive system provides a unique blend of options for both novice and experienced traders in the cryptocurrency market.

Bitget Launchpad

Bitget Launchpad is a feature on the Bitget trading platform that allows you to invest in emerging crypto projects. To participate, you need to hold BGB, Bitget’s own token. Holding BGB earns you lottery tickets, which are your key to purchasing tokens from these new projects. The more BGB you hold, the greater number of tickets you can acquire.

This program has been instrumental in launching various projects across different sectors like gaming, NFTs, the Metaverse, and DeFi. Notable projects include T2T2, TYPE, CryptoBlades, PolkaWar, and PolkaCity. The Launchpad aids these crypto startups by providing access to Bitget’s resources, aiding in their growth and community building. For investors, this is an opportunity to discover promising projects at their inception, potentially benefiting from the growth of their tokens and other rewards.

Bitget Mobile App

The Bitget mobile app has a user-friendly interface that’s great for both new and seasoned traders. This app, available for iOS and Android, mirrors the capabilities of the web version. You have the option to follow the strategies of top traders, use trading bots for automation, and earn passive income through Bitget Earn. The app facilitates swift deposits and withdrawals of both cryptocurrencies and fiat currencies.

You can easily download it from the App Store or Google Play Store. Its design focuses on simplicity and efficiency, making it accessible for anyone interested in crypto trading. Whether you’re at home or on the move, this app provides a seamless and secure trading experience, keeping you connected to the crypto market.

Staking

Bitget offers an option to stake your cryptocurrency, a process where you lock your assets in a smart contract. This action helps in validating transactions on networks that use proof-of-stake (PoS) mechanisms. You’ll find a variety of PoS coins available for staking on Bitget, including ATOM, SOL, MATIC, among others.

What’s great about staking through Bitget is the security and convenience it offers. You’re not just limited to one blockchain; cross-chain staking is also supported. This means more flexibility for you. You can choose from different staking durations and Annual Percentage Rates (APRs), which allows you to maximize your earnings through compound interest.

Another advantage is the liquidity it provides. If you need to access your funds, you can withdraw your staked assets at any time. Typically, you’ll receive both your principal and the accrued interest within one working day. This feature makes Bitget an attractive platform for those looking to earn passive income through crypto staking, offering a blend of flexibility, security, and convenience.

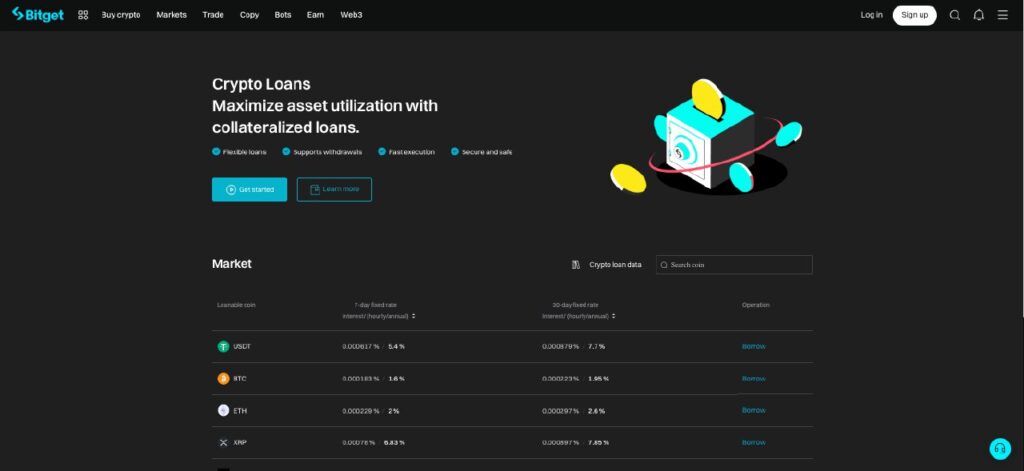

Crypto Loans

Imagine you have some crypto assets and you want to borrow more. Bitget makes this possible. You pledge your crypto assets, like Bitcoin or Ethereum, as collateral. In return, Bitget lends you other crypto assets. It’s a bit like getting a loan, but with cryptocurrency.

Here’s how it works: You choose a pair, maybe you have USDT and you want to borrow BTC, or perhaps you have ETH and you’re looking to get some USDC. Bitget has a variety of these pairs for you to pick from. The neat part? You can borrow up to 70% of your collateral’s value. This means if your collateral is worth $100, you can get a loan of up to $70 in another crypto asset.

The terms are quite flexible. The interest rates are low, making it an attractive option if you need quick access to different crypto assets. And when I say quick, I mean it – the process is fast, often completed within minutes. But here’s something crucial: Bitget doesn’t leave you to navigate this alone. They provide risk alerts and margin calls. These are tools to help you manage your loan effectively, keeping you informed about the health of your collateral and when you might need to take action.

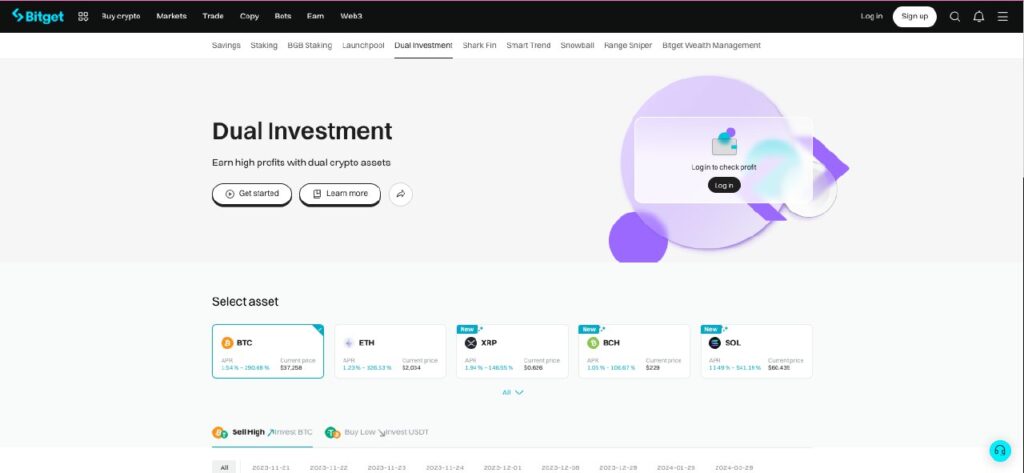

Dual Investment

Bitget’s Dual Investment lets you play with two cryptocurrencies to make a profit. You pick a main currency, like USDT, and a second one, say BTC. Then, you set a price goal for BTC. If BTC hits or goes beyond this price while you’re in the game, you’ll end up with BTC. But if BTC doesn’t reach your set price, you’ll get USDT back. This could mean a loss, depending on BTC’s price at that time.

Let’s say you go for a dual deal where you can sell ETH at $1,500, using USDT as your main currency, and the deal closes in a week. On the closing day, if ETH is $1,500 or more, you’ll sell your ETH at that price and get USDT. But if ETH hasn’t hit $1,500, you’ll get your ETH back. Watch out, though – if ETH’s market price has shifted, you might face a loss.

The yearly profit rate (APR) from these dual deals varies. It depends on how the market’s doing and the price goal you set. Remember, it’s all about the right timing and price moves in the crypto world.

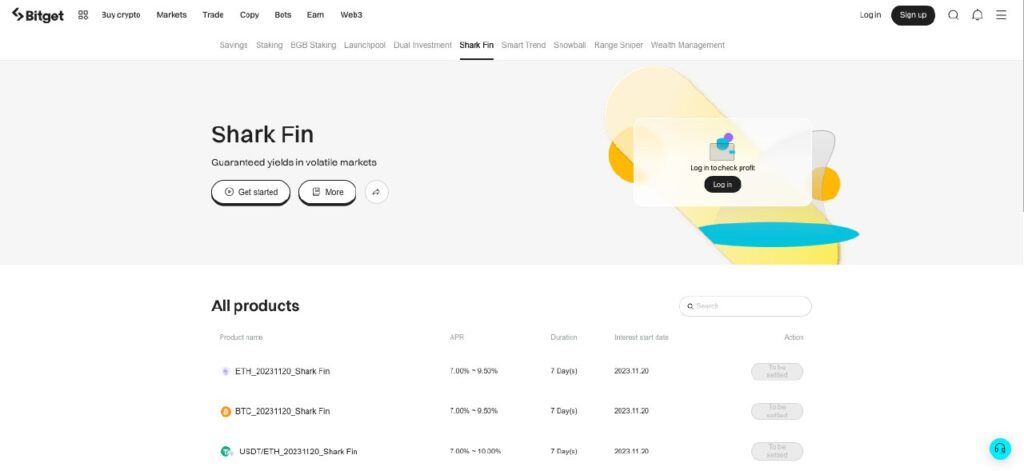

Shark Fin

Bitget Shark Fin offers you a unique opportunity to expand your cryptocurrency investments with minimal risk and promising returns. This product guarantees your capital, making it a safe choice for those who prefer stable earnings without much risk.

As an investor, you have the freedom to choose the tokens you wish to invest in from the Bitget Shark Fin range. The platform provides clear information about the expected Annual Percentage Rate (APR), the subscription period, and price range forecasts. Once you invest, your principal and earnings are secured until the maturity date.

However, remember that Bitget Shark Fin is a lock-up investment, meaning you cannot access your funds before the agreed date. This product is ideal if you’re looking for a reliable way to grow your crypto assets with a structured investment approach that balances safety and profitability.

Security

Bitget places a high emphasis on the security and privacy of its users. They implement various strategies to protect user data and assets.

Bitget employs encryption and hashing techniques. They convert data into encrypted codes, which require a specific key to decrypt. Additionally, they generate unique values from data, particularly for sensitive information like passwords and keys. This data is then scrambled and stored securely on their servers, ensuring it remains inaccessible and unaltered in case of theft or loss.

The platform uses Two-Step Verification (2SV). Users must provide a code from a separate device or app when logging in or making withdrawals. This extra layer of security ensures that account access is not possible with just the password.

To combat phishing, Bitget allows users to create a unique anti-phishing code for their emails. This code helps users distinguish authentic communications from Bitget, helping them avoid malicious links or files.

Regarding asset storage, Bitget utilizes both cold and hot storage methods. The majority of user funds are stored in cold storage wallets, which offer enhanced security and are more difficult to compromise. A smaller portion of funds is kept in hot wallets for daily transaction purposes.

Bitget has achieved 12 A+ scores from SSL Labs, a renowned authority in web security. SSL Labs evaluates the security of websites and servers, focusing on aspects like encryption strength, protocol support, certificate validity, and vulnerability assessment.

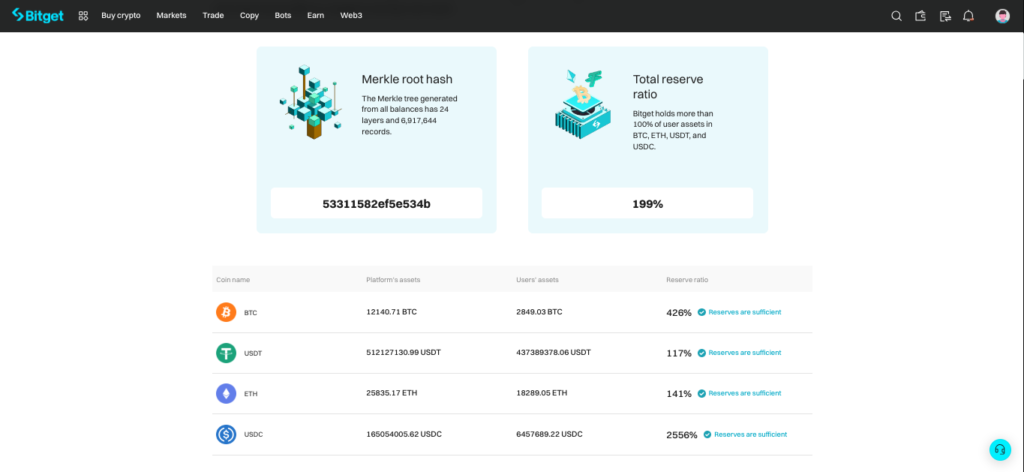

Bitget Proof of Reserves

In the wake of FTX’s collapse, the phrase “not your keys, not your coins” has become a rallying cry and has pushed centralized exchanges to demonstrate the security of user funds. Typically, exchanges offer earning programs where users relinquish control of their funds for yield, making the safety of these funds a top priority.

Proof of Reserves is a cryptographic method that assures customers their funds are available for withdrawal, barring any issues with their staked assets. This process is designed to instill confidence that an exchange’s liabilities don’t exceed customer deposits and that these deposits are fully backed.

Bitget, although a bit late to the game compared to others, has shown a commendable effort in this area. Their Proof of Reserves page, as of November 2nd, 2023, displays their reserves for BTC, USDT, and ETH, which significantly exceed their held assets.

Their approach to Proof of Reserves involves verifiable auditing procedures, checks of public wallet ownerships, and regular audits to confirm their holdings. Notably, Bitget commits to monthly snapshots of their asset reserves, a practice not commonly seen in other exchanges.

However, Bitget’s approach is primarily self-assessment, lacking independent audits. This method, also used by Binance, has faced criticism for only presenting part of the story. The transient nature of funds during audits, access to private keys, and potential internal fund transfers (as seen in the FTX case) are factors that Proof of Reserves doesn’t address.

Customer Support

Every second counts in crypto trading and that’s why having reliable customer support is crucial. You know, when you’re just starting out as a trader, navigating through the complexities of live trades, the last thing you want is a platform glitch or an unresolved issue. Quick and effective support can mean the difference between a minor setback and a devastating loss.

You might recall that big Twitter spat between a crypto trader , Coin Mamba and Binance. It was a heated issue that boiled down to issues with customer support. It highlighted just how vital good customer support is in this industry. It’s not just about resolving technical issues; it’s about trust and reliability in a field where fortunes can change in an instant.

Bitget offers round-the-clock support in multiple languages. Whether it’s through live chat or email at [email protected], they’re there to assist.

They’ve also got a comprehensive FAQ and self-help section, packed with tutorials and articles to guide traders through common issues.

If you’re curious about Bitget’s global trading platform, you can reach out directly via email or their help center. For wallet-related queries, there’s a dedicated email at [email protected]. And if P2P trading is your thing, they’ve got a handy “customer service join chat” feature right on the trade page for immediate assistance.

I’ve personally tested their live chat support several times. Each time, I was connected to an agent in under five minutes, and the quality of support was impressive. The agents were well-versed in the platform’s offerings. The self-help section, too, is a treasure trove of useful information.

Bitget also maintains an active presence on Telegram, Discord, and Reddit. These communities can be a goldmine for information and peer support. But a word of caution: always be wary of scammers lurking in these spaces, ready to pounce with requests for sensitive information.

Conclusion

Bitget stands out as a crypto exchange that’s more than just about trading. You’ll find it’s gaining traction for its advanced trading features, user-friendly design, and top-notch copy trading capabilities. If you’re considering a new crypto exchange, Bitget is a strong contender. It not only offers lower fees than most exchanges but also provides unique features like copy trading, a launchpad, and a variety of savings assets.

Bitget is a legitimate and reliable choice for anyone into crypto trading. It’s hard to overlook this platform, offering futures trading, spot buying and selling, copy trading, and automated portfolio management with smart bots.

FAQ

Is Bitget Legal in the USA?

You can use Bitget in the US. It has a US MSB license, which means it follows US regulations. This allows US customers to complete KYC. But, remember, in the US, you might not get access to all features like futures and margin trading.

Is Bitget a Safe Platform?

Bitget is a secure choice. It has several safety measures like hashed passwords, two-factor authentication, mandatory KYC, cold storage for funds, and protection funds. It’s transparent too, with regular reports and a Proof-of-Reserves system showing they have enough funds.

Does Bitget Require KYC?

Yes, Bitget asks all users to complete KYC. This includes checking your identity for the first level and your address for the second. It’s to make sure you are who you say you are and to stop illegal activities. Bitget makes this easy with eKYC technology, like facial recognition and matching your ID with your live photo. Completing your KYC gives you access to multiple levels of withdrawal limits.

Is Bitget Good for Beginners?

Bitget is user-friendly for beginners, but its trading products and concepts are more for those with experience in trading.