Dollar-Cost Averaging (DCA) is the common term for the investment strategy where assets (or crypto) is purchased at intervals. Instead of putting all your money in one go, you spread your funds by buying at particular times (preferably at lower prices, or timely i.e. once a week), all as an attempt to lower your cost (per stock/share/coin).

A potential solution to a “What if it goes down?” situation.

Pick a scenario

Scenario A: You decide to invest $500 in a cryptocurrency which is currently trading at let’s say $6, giving you around 83.3 coins. You watch the price over a few days as it slowly goes down to $4. Unsure of this coin’s valuation, you want to get out of this position; to avoid making a loss, you wait for it to come back to $6 but it just doesn’t happen. You see the price fluctuating between $3 and $4. Conveniently, after you accept your losses by selling, the price surges to $9. Sound familiar? Possibly… This kind of movement is very common in the crypto market.

Ultimately, you could have just waited the whole time – but as far as you know, you are new to this. Unsure about the asset you’ve just invested in or the market in general, what’s a safer option?

Scenario B: Instead, you can spend $300 (for $6 per coin) on the first week, and $200 (for $4 per coin)in the second. Not only do you now have more coins (100) than Scenario A, you will be profitable as long as you sell above $5.20 – a lower average cost.

Scenario C: Similar to the last scenario, you spend $300 in the first week and $200 in the second, only this time the price goes up to $8 instead of falling. Your average cost is higher compared to A and B, however if you decided to wait for the price to fall, you would be getting a better value than $5.

The Math

(Cost1 divided by Budget) multiplied by Price1

PLUS

(Cost2 divided by Budget) multiplied by Price2And so on…. until you’re done buying. The final answer will be your new reference point.

Does it work all the time?

It’s not recommended to DCA in every investment at any time; as you gain experience in the market, you will build confidence to judge projects or even perform high-level technical analysis. The technique is usually used when there’s FUD or undervaluation, especially in a volatile market. You can’t time the absolute bottom of the asset price or market, so this is one of many useful strategies in entry points.

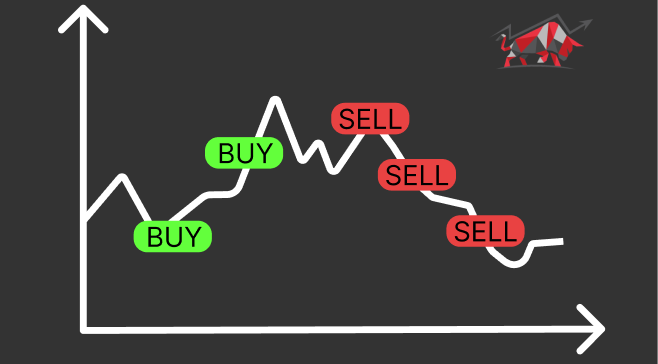

What about selling?

Investors also take profits through DCA, selling at whatever intervals they’re comfortable with. As you may guess, they don’t sell everything at once because catching the top is impossible, too – avoiding the risk of missing out on extra profit if the asset price goes up after they’ve sold.

Final Thoughts

It’s a good strategy if you have a low-risk tolerance and a large budget. It’s easier to commit to than spending it all in one go. Though DCA shouldn’t be done all the time, some people do it weekly, monthly, or every six months (for a certain time, or even forever). As you get more familiar with the market, you’ll be able to judge which projects have potential, and when you’re that sure of something, the fear of losing money won’t be much of an obstacle.

Disclaimer: Not financial or investment advice. DCA does not eliminate risk but rather reduces the risk of a poorly-timed investment. Please research before investing.