Here’s a question that sounds stupid but cuts straight to the heart of crypto’s biggest contradiction: If stablecoins are supposed to be stable, just digital dollars maintaining a $1 peg, why do we have over 280 of them fighting for market share?

The stablecoin market now exceeds $314 billion, yet around 280 stablecoins, according to CoinMarketCap, are distributed globally, with new ones launching constantly despite the sector being dominated by just two players. Tether (USDT) holds over $150 billion in market cap, while USD Coin (USDC) sits around $70-75 billion—together accounting for roughly 70% of the entire market. So what exactly are the other 278 stablecoins doing?

The Money Printer Business Model

To understand why stablecoins keep multiplying like rabbits, you need to grasp the absurdly profitable business model. Stablecoin issuers collect real dollars from users, hold them in ultra-safe assets like US Treasury bills, pocket the interest, and return the principal when users redeem. It’s essentially free money.

Tether brought in $13 billion in profit in 2024, roughly double that of BlackRock, the world’s largest asset manager. Think about that for a second: a company that essentially runs a digital money market fund earned more than an investment giant managing trillions. The profit margins are that huge because the cost of operation is minimal once the infrastructure exists.

With returns like that, everyone wants a piece. Banks are launching stablecoins. Tech companies are launching stablecoins. Even President Trump’s World Liberty Financial platform launched USD1 in 2025. When money literally prints itself through Treasury interest while you sleep, why wouldn’t you try?

The regulatory landscape has accelerated this gold rush. The US passed the GENIUS Act in mid-2025, providing clear rules for stablecoin issuers, while Europe’s MiCAR framework became applicable to stablecoins on June 30, 2024. This regulatory clarity removed the biggest barrier to entry to stablecoins: legal uncertainty.

Market Fragmentation Serves Real Purposes

But dismissing all 280 stablecoins as redundant copies misses important market dynamics. These stablecoins serve genuinely distinct use cases that justify their existence.

Geographic specialization matters most. In Latin America, 71% of stablecoin activity is tied to cross-border payments.

Infographic from Fireblocks

Blockchain diversity also drives proliferation. Ethereum holds about 70% of the stablecoin supply, while Binance Smart Chain holds approximately 15%. But Solana and Tron are increasing in stablecoin circulation, particularly for payments requiring faster settlement or lower fees. Each blockchain ecosystem needs native stablecoin liquidity, which sometimes means issuing platform-specific versions.

Regulatory arbitrage also explains why there are so many stablecoins. Some issuers avoid US jurisdiction by operating offshore. Others specifically pursue full MiCA compliance in Europe, where USDC is the only top-ten stablecoin to achieve authorization while USDT does not currently meet requirements. As regulations tighten, compliant alternatives become valuable for users who can’t legally access dominant but unregulated options.

The Coming Consolidation Wave

Yet despite these legitimate reasons for diversity, the brutal truth is that most stablecoins will fail. The historical precedent is damning.

The May 2022 collapse of TerraUSD (UST), once the fourth-largest stablecoin with an $18 billion market capitalization, demonstrated how catastrophically algorithmic stablecoins can implode. Within days, UST plummeted from $1 to mere pennies, triggering $42 billion in losses and destroying the broader Terra ecosystem valued at over $50 billion in market capitalization.

The Terra collapse wasn’t an isolated incident. Early failures like the 2018 collapse of NuBits showed how fragile unbacked algorithmic models can be. Even fiat-backed giants have stumbled, with Tether’s USDT briefly dropping to $0.80 in 2018 amid solvency fears and USDC losing its peg in 2023 after Silicon Valley Bank collapsed.

Network effects favour concentration. Stablecoin transaction volumes reached nearly $970 billion in August 2025, with forecasts pointing toward $1 trillion monthly flows by the end of 2026. That volume overwhelmingly flows through the top stablecoins because liquidity attracts more liquidity. Traders use USDT and USDC because everyone else does, creating a self-reinforcing dominance that smaller stablecoins can’t overcome.

Compliance costs will also accelerate consolidation. The GENIUS Act and MiCAR impose requirements for reserve asset management, audits, transparency, anti-money laundering controls, risk management frameworks, and protection of user information. Meeting these standards requires substantial legal, technical, and operational infrastructure. Small stablecoin projects operating on shoestring budgets can’t afford it.

These many factors will separate the weed from the wheat in no time with the best and most functional stablecoins left in the harvest.

The Survivors Will Serve Specific Niches

However, market consolidation doesn’t mean we’ll end up with just one or two stablecoins. The future likely holds a tiered structure where dominant players control mainstream payments and trading, while specialized stablecoins serve particular needs.

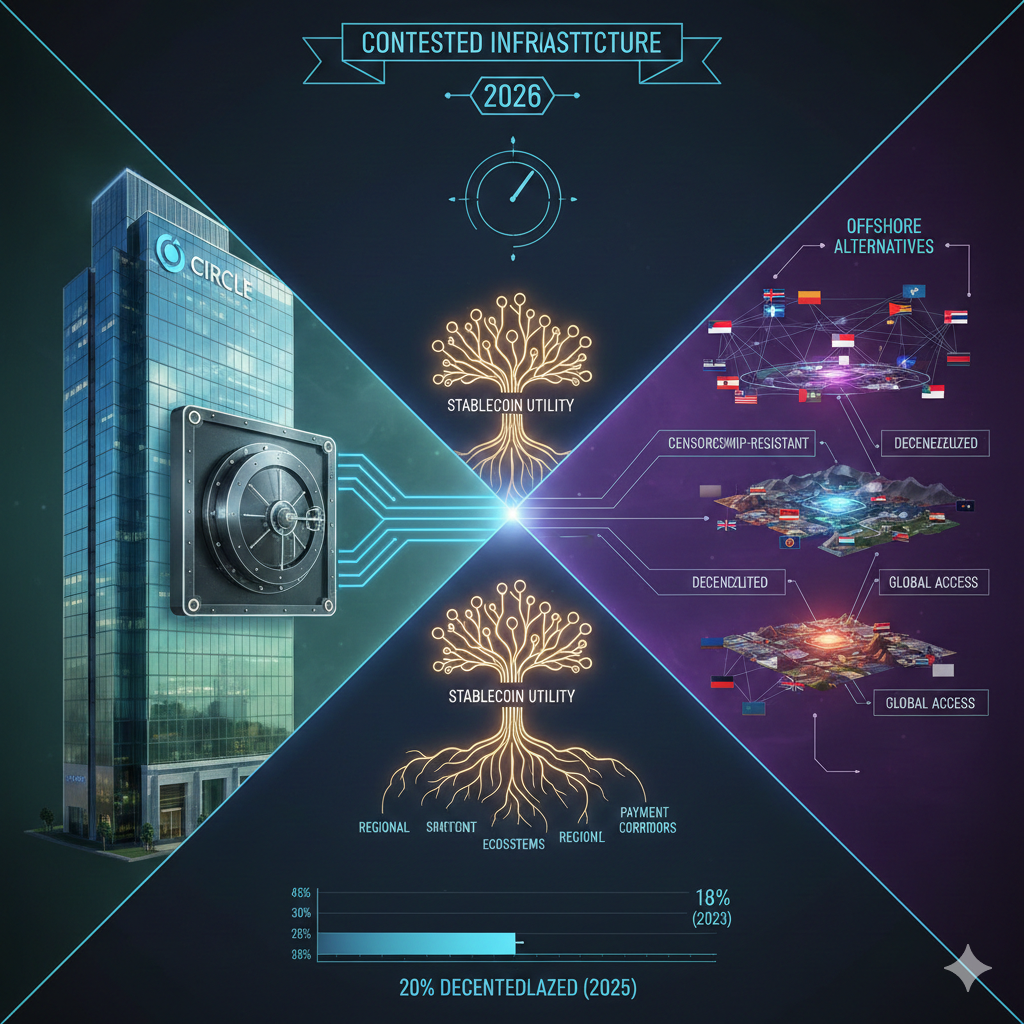

By 2026, stablecoins function as contested infrastructure, with a structural bifurcation between regulated onshore stablecoins distributed through supervised channels and embedded into institutional workflows, versus offshore alternatives. This split creates space for both Circle’s USDC serving US institutional clients and offshore alternatives serving users who can’t access regulated options.

Decentralized stablecoins will persist as ideological and technical alternatives. Decentralized stablecoins represent 20% of the stablecoin market in 2025, up from 18% in 2023, showing modest but real growth for censorship-resistant alternatives that don’t rely on centralized issuers or bank custody.

Regional and specialized stablecoins targeting specific payment corridors, blockchain ecosystems, or compliance frameworks will survive if they genuinely serve needs that dominant stablecoins don’t address. But the bar for survival will be so high that stablecoins will need real utility, regulatory compliance, adequate reserves, and sufficient scale to maintain liquidity.

Innovation is Key

So why do we need 100-plus stablecoins? We don’t. We need maybe 10-15 well-designed, properly backed, appropriately regulated stablecoins serving distinct market segments. The other 260+ stablecoins exist because crypto remains a permissionless, entrepreneurial ecosystem where anyone can launch a token, raise capital, and try their luck.

That’s actually a feature, not a bug. The stablecoin proliferation we’re seeing mirrors the early internet when thousands of search engines competed before Google emerged or when hundreds of social networks launched before Facebook dominated. Market Darwinism is brutal but effective; it kills bad ideas while allowing good ones to prove themselves.

The Terra collapse, as devastating as it was, provided valuable lessons. It showed the fundamental failures of algorithmic stablecoins and highlighted the importance of proper collateralization. The market learned, regulations tightened, and surviving stablecoins improved their designs. Innovation requires experimentation, and experimentation produces casualties, unfortunately.

From my years covering cryptocurrencies, here’s what I’ve learned about stablecoin proliferation: The question isn’t whether we need 280 stablecoins—we obviously don’t. The question is whether the process generating 280 experiments is worth the inevitable 280 failures. If those failures teach us how to build better monetary infrastructure, prevent fraud through hard-won experience, and ultimately produce stablecoins that serve billions of users more efficiently than traditional banking, then yes, the creative destruction is worth it.

The market is already delivering its verdict. The market focuses on USDT and USDC not because of monopolistic practices but because they’ve earned trust through years of maintaining their pegs, surviving stress tests, and providing reliable liquidity. Meanwhile, hundreds of smaller stablecoins fight for scraps, and many will quietly disappear.

The survivors, whether dominant incumbents or specialized alternatives, will have proven they deserve to exist by solving real problems better than competitors. That’s exactly how markets should work, and why permissionless innovation, despite producing countless failures, remains crypto’s greatest strength.