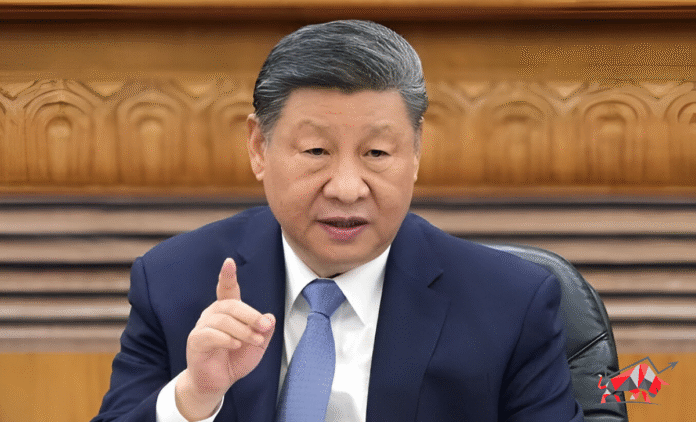

Chinese President Xi Jinping delivered an unusually frank criticism of local governments at the Central Urban Work Conference, highlighting growing concern about over-investment in artificial intelligence (AI), computing power, and electric vehicles (EVs). He pointed out that provinces from Xinjiang to Inner Mongolia are building data centres and EV plants without sufficient strategy or expertise.

Xi warned that this “involution”, or redundant industrial competition, is fuelling deflation and could saddle the country with debt. He particularly targeted officials he labelled “three pats”: those who boast irresponsibly and then step away from the consequences. This marks a clear shift in messaging from prior denials of overcapacity issues.

Overcapacity and Price Wars Deepen Deflation

China’s economy is now in its longest deflationary phase since the 1990s, with the GDP deflator falling for nine consecutive quarters. Producer prices dropped 3.6% in June—the sharpest decline in nearly two years. The government sees a clear link between this deflationary trend and the price competition among EV manufacturers, as well as excessive data-centre build‑outs, which are draining chip resources and reducing profit margins.

Local Governments Fuel the Frenzy

According to official analysis, provinces are competing to attract investment in AI and EVs, often offering tax breaks, low-cost land and subsidies. The rush has created duplicated infrastructure that lacks technical capacity and yields weak returns. For example, many small cities lack the skilled workforce or market to support high-performance data centres, while EV makers have launched price wars that erode global competitiveness and strain local budgets.

Central Government to Rein In Excess

Xi stressed that measuring economic success extends beyond GDP and counting new projects. Local debt and future liabilities must also be considered. He warned: “We should not let some people pass the buck and leave problems to future generations.”

This echoes recent statements by industrial and economic authorities who have urged higher standards in production and warned of disorderly price competition in sectors from solar to cement. Analysts see these as signs of preparatory “supply‑side reforms” aimed at curbing excess capacity.

A Shift in China’s Economic Strategy

This more cautious tone from Beijing is notable. Just a year ago, Xi dismissed suggestions of overcapacity during a visit to France. Now the government is not only acknowledging problems but also outlining intentions to intervene—particularly in smaller cities—while tech hubs like Beijing and Shenzhen may continue receiving investment.

China’s deflationary cycle is partly driven by domestic oversupply, but it also affects global markets. Lower producer prices for Chinese-made goods—from EVs to steel—risk provoking trade tensions, as foreign competitors claim unfair competition. Domestically, prolonged price declines suppress corporate profit and undermine consumer confidence, reinforcing a cycle of weak demand.

What Comes Next?

Markets are now betting on stronger regulation. Industry bodies in solar and cement have already announced production cuts, while authorities may soon:

- Enforce tighter environmental and financial controls on surplus sectors

- Restrict local governments from offering excessive subsidies

- Close or consolidate underperforming firms

- Redirect capital flows toward innovation hubs and demand‑driven sectors

Economists caution that shifting away from China’s traditional investment‑led growth model will take time and political coordination. However, it may yield a more efficient, balanced economy capable of long‑term stability.This article is based on reporting from the Financial Times.