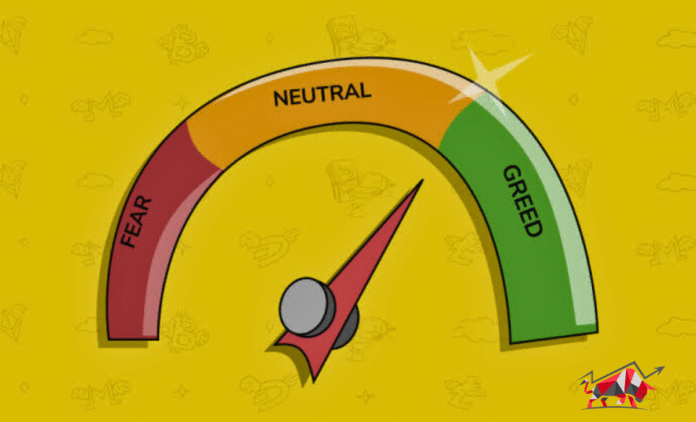

The Crypto Fear & Greed Index, a popular gauge of market sentiment, has maintained its stance in the “greed” territory even as geopolitical tensions spiked following Israel’s recent airstrikes on Iran.

On Sunday, the Index posted a score of 60, showing continued investor optimism despite heightened conflict and market jitters. The sentiment remains notably high, though it has cooled slightly from Thursday’s “greed” reading of 71.

Bitcoin Dips but Holds Key Levels

Bitcoin’s price dipped 2.8% to $103,000 on Friday after explosions were reportedly heard in Tehran late Thursday, with Israel later claiming responsibility. Iran retaliated the following evening with a volley of ballistic missiles, escalating regional uncertainty.

Read More: Oil Prices Surge as Middle East Tensions Escalate

Despite the turmoil, Bitcoin demonstrated relative strength, rebounding to $105,540 at the time of publication, according to CoinMarketCap. The decline interrupted its momentum as it approached its all-time high of $111,970 set on May 22.

Ether saw a steeper fall, shedding 10.79% to hit a low of $2,454 before recovering to $2,534.

Analysts Highlight Bitcoin’s Resilience

Crypto analyst Za pointed to Bitcoin’s composure under pressure, posting on X: “Bitcoin does not seem concerned about the Israel and Iran conflict (yet). There is no better indicator than Bitcoin, which makes this notable, in my opinion.”

Crypto investor and entrepreneur Anthony Pompliano echoed the sentiment, calling Bitcoin “relentless” in a separate Saturday post.

Market participants continue to defend the key psychological support at $100,000, a level reclaimed on May 8 for the first time in three months. Should Bitcoin fall below this mark, it could trigger liquidations exceeding $1.74 billion in long positions, based on CoinGlass data.

Bitcoin ETFs Post Another Week of Gains

In institutional markets, spot Bitcoin ETFs recorded a fifth consecutive week of inflows, drawing $1.37 billion in the trading week ending Friday, according to data from Farside Investors.

In contrast, spot Ether ETFs saw their 19-day inflow streak snapped, posting net outflows of $2.1 million on Friday.

Despite geopolitical headwinds, the crypto market’s sentiment metrics and capital flows suggest traders remain bullish — for now.