US Senator Cynthia Lummis has reintroduced the BITCOIN Act, a bill that could see the US government amass over 1 million Bitcoin as part of a newly proposed strategic Bitcoin reserve.

The Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act of 2025 directs the government to purchase 200,000 BTC annually over five years, using funds from the Federal Reserve and the Treasury Department. However, the bill also allows for additional Bitcoin acquisitions through legal means other than direct purchases, such as:

- Civil or criminal forfeitures

- Gifts made to the US government

- Transfers from federal agencies

- Voluntary contributions from US states, which will be stored in segregated accounts

Cynthia Lummis: A Step Toward Strengthening US Financial Innovation

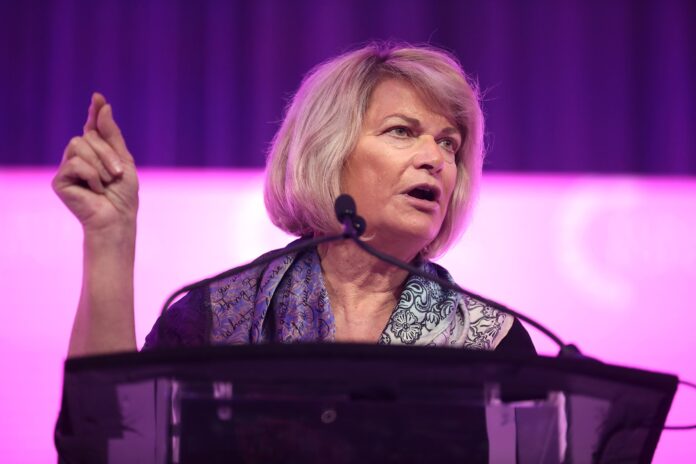

Announcing the bill at a March 11 Bitcoin Policy Institute conference, Lummis emphasized the role of Bitcoin in tackling national debt and ensuring America’s dominance in digital finance.

“By transforming the president’s visionary executive action into enduring law, we can ensure that our nation will harness the full potential of digital innovation to address our national debt while maintaining our competitive edge in the global economy,” Lummis stated.

The bill has secured new co-sponsors, including Republican Senators Jim Justice, Tommy Tuberville, Roger Marshall, Marsha Blackburn, and Bernie Moreno. Justice praised the initiative, stating:

“This bill represents America’s continued leadership in financial innovation, bolsters both our economic security, and gives us an opportunity to wrangle in our soaring national debt.”

Handling Forked and Airdropped Bitcoin Assets

A significant update in the reintroduced bill is the creation of a formal process for managing Bitcoin forked assets and airdrops held in the reserve.

Initially, the bill required all forked assets to be held for at least five years without the option of sale or disposal. However, the revised version directs the Treasury Secretary to evaluate and retain the most valuable forked asset based on market capitalization once the holding period expires.

Bitcoin has forked multiple times in the past, with notable examples including Bitcoin Cash (BCH) in 2017 and Bitcoin Gold (BTG) in 2017.

Tied to Trump’s Executive Order on Bitcoin Reserves

The BITCOIN Act’s reintroduction follows President Donald Trump’s recent executive order to establish both a Strategic Bitcoin Reserve and a Digital Asset Stockpile.

- The Bitcoin reserve will accumulate Bitcoin from government-seized crypto assets without selling them, instead using budget-neutral strategies to grow its holdings.

- The Digital Asset Stockpile, however, will include crypto assets that the government may sell.

With the US making a bold move into Bitcoin-backed reserves, the BITCOIN Act could mark a turning point in how the government views and utilizes digital assets within its financial strategy.